Question: solve these 3 problems please Required information Problem 10-3A Indicate effect of stock dividends and stock splits (LO10-6) The following information applies to the questions

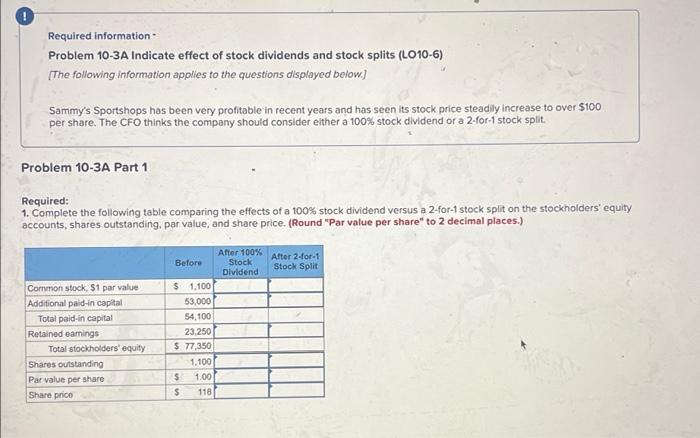

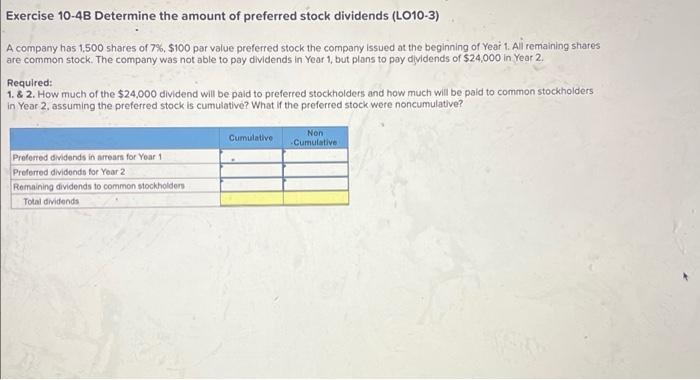

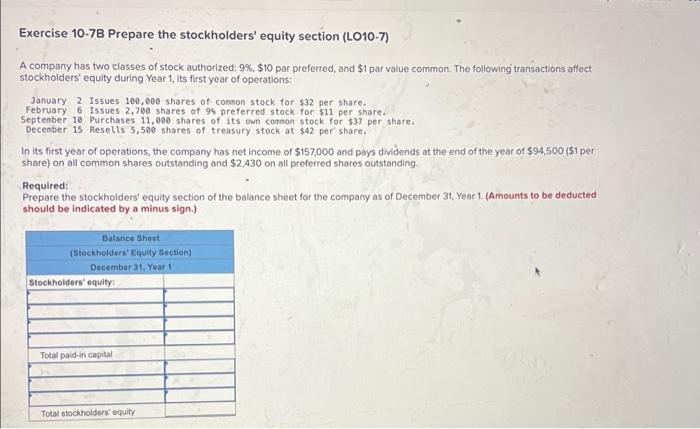

Required information Problem 10-3A Indicate effect of stock dividends and stock splits (LO10-6) The following information applies to the questions displayed below.) Sammy's Sportshops has been very profitable in recent years and has seen its stock price steadily increase to over $100 per share. The CFO thinks the company should consider either a 100% stock dividend or a 2-for-1 stock split Problem 10-3A Part 1 Required: 1. Complete the following table comparing the effects of a 100% stock dividend versus a 2-for-1 stock split on the stockholders' equity accounts, shares outstanding, par value, and share price. (Round "Par value per share" to 2 decimal places.) Before After 100% Stock Dividend After 2-for-1 Stock Split Common stock, $1 par value Additional paid-in capital Total paid-in capital Retained earnings Total stockholders' equity Shares outstanding Par value per share Share prico $ 1.100 53,000 54.100 23,250 $ 77,350 1.100 $ 1.00 $ 118 Exercise 10-48 Determine the amount of preferred stock dividends (L010-3) A company has 1.500 shares of 7%, $100 par value preferred stock the company issued at the beginning of Year 1. All remaining shares are common stock. The company was not able to pay dividends in Year 1, but plans to pay dividends of $24,000 in Year 2 Required: 1. & 2. How much of the $24,000 dividend will be paid to preferred stockholders and how much will be paid to common stockholders in Year 2. assuming the preferred stock is cumulative? What if the preferred stock were noncumulative? Cumulative Non Cumulative Preferred dividends in arrears for Yoar 1 Preferred dividends for Year 2 Romaining dividends to common stockholders Total dividends Exercise 10-7B Prepare the stockholders' equity section (L010-7) A company has two classes of stock authorized: 9%, $10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during Year 1, its first year of operations: January 2 Issues 100,000 shares of common stock for $32 per share. February 6 Issues 2,700 shares of 99 preferred stock for $11 per share. September 10 Purchases 11,000 shares of its own common stock for $37 per share. December 15 Resells 5,500 shares of treasury stock at $42 per share. In its first year of operations, the company has net income of $157,000 and pays dividends at the end of the year of $94,500 (51 per share) on all common shares outstanding and $2,430 on all preferred shares outstanding Required: Prepare the stockholders' equity section of the balance sheet for the company as of December 31, Year 1 (Amounts to be deducted should be indicated by a minus sign.) Balance Sheet (Stockholders' Equity Section) December 31, Year 1 Stockholders' equity Total paid in capital Total stockholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts