Question: solve these finance cash flow model using excel Multiple uneven cashflows 1. Suppose you plan to deposit $100 into an account 1 year from today

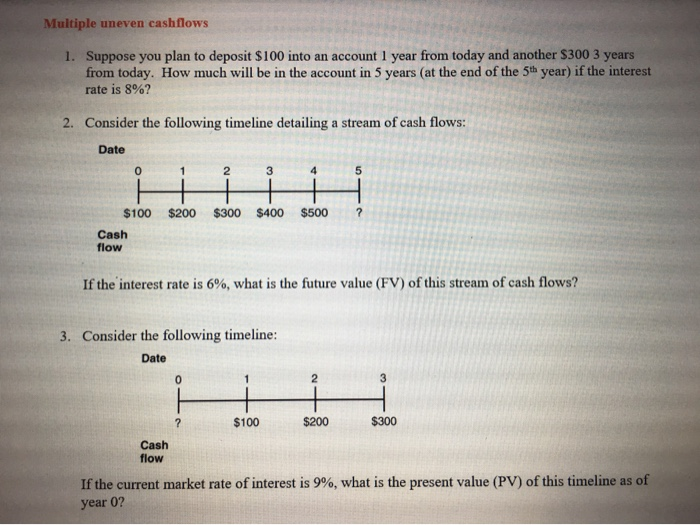

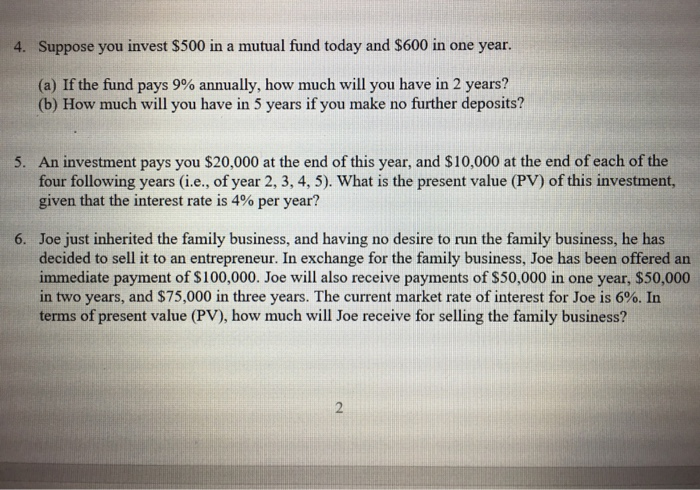

Multiple uneven cashflows 1. Suppose you plan to deposit $100 into an account 1 year from today and another $300 3 years from today. How much will be in the account in 5 years at the end of the 5th year) if the interest rate is 8%? 2. Consider the following timeline detailing a stream of cash flows: Date 1 2 3 $200 $300 $400 $500 $100 Cash flow If the interest rate is 6%, what is the future value (FV) of this stream of cash flows? 3. Consider the following timeline: Date $100 $200 $300 Cash flow If the current market rate of interest is 9%, what is the present value (PV) of this timeline as of year 0? 4. Suppose you invest $500 in a mutual fund today and $600 in one year. (a) If the fund pays 9% annually, how much will you have in 2 years? (b) How much will you have in 5 years if you make no further deposits? 5. An investment pays you $20,000 at the end of this year, and $10,000 at the end of each of the four following years (i.e., of year 2, 3, 4, 5). What is the present value (PV) of this investment, given that the interest rate is 4% per year? 6. Joe just inherited the family business, and having no desire to run the family business, he has decided to sell it to an entrepreneur. In exchange for the family business, Joe has been offered an immediate payment of $100,000. Joe will also receive payments of $50,000 in one year, $50,000 in two years, and $75,000 in three years. The current market rate of interest for Joe is 6%. In terms of present value (PV), how much will Joe receive for selling the family business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts