Question: solve these in a table form EXERCISE 9-13 Direct Materials and Direct Labor Budgets [LO4, LO5] The production department of Hareston Company has submitted the

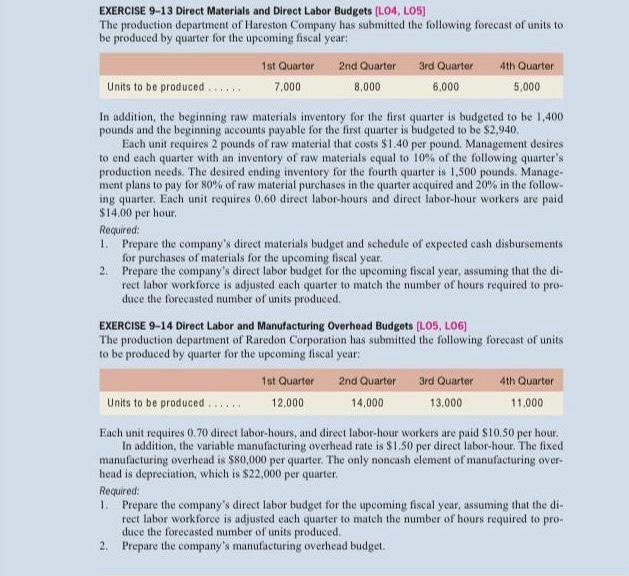

EXERCISE 9-13 Direct Materials and Direct Labor Budgets [LO4, LO5] The production department of Hareston Company has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: In addition, the beginning raw materials inventory for the first quarter is budgeted to be 1,400 pounds and the beginning aceounts payable for the first quarter is budgeted to be $2,940. Each unit fequires 2 pounds of raw material that costs 51.40 per pound. Management desires to end each quarter with an inventory of raw materials equal to 10 of of the following quarter's production needs. The desired ending itiventory for the fourth quarter is 1.500 pounds. Management plans to pay for 80% of raw material purchases in the quarter acquired and 20% in the following quarter. Each unit requires 0,60 direet labor-hours and direct labor-hour workers are paid $14.00 per hour, Recuired: 1. Prepare the company's direct materials budget and sehedule of expected cash disbursements for purchases of materials for the upcoming fiscal year. 2. Prepare the company's direet labor budget for the upcoming fiseal year, assuming that the direct labor workforce is adjusted each quarter to mateh the number of hours required to peoduce the forecasted number of units produced. EXERCISE 9-14 Direct Labor and Manufacturing Overhead Budgets [LO5, LO6] The production department of Raredon Corporation has subtnitted the following forecast of units to be produeed by quarter for the upeoming liscal year; Each unit requires 0.70 direct labor-hours, and direct labor-hour workers are paid $10.50 per hour. In addition, the yariable manufacturing overhead rate is $1.50 per direct labor-hour. The fixed manufacturing overhead is $80,000 per quarter. The only noncash element of manufacturing overhead is depreciation, which is $22,000 per quarter. Required: 1. Prepare the company's direct labor budget for the upeoming fiscal year, assuming that the direet labor workforce is adjusted each quarter to mateh the number of hours required to produce the forecasted number of units produced. 2. Prepare the company's manufacturing ovethead budget

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts