Question: solve these please Question 16 ( 6 points). Bond A pays an 8% annual coupon, has a YTM of 6%, and has 12 years to

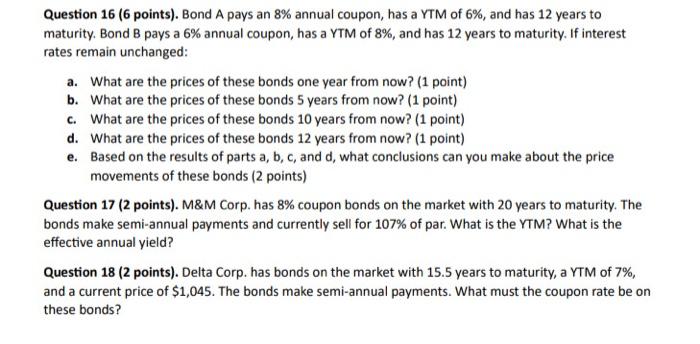

Question 16 ( 6 points). Bond A pays an 8% annual coupon, has a YTM of 6%, and has 12 years to maturity. Bond B pays a 6% annual coupon, has a YTM of 8%, and has 12 years to maturity. If interest rates remain unchanged: a. What are the prices of these bonds one year from now? (1 point) b. What are the prices of these bonds 5 years from now? (1 point) c. What are the prices of these bonds 10 years from now? (1 point) d. What are the prices of these bonds 12 years from now? (1 point) e. Based on the results of parts a, b, c, and d, what conclusions can you make about the price movements of these bonds ( 2 points) Question 17 ( 2 points). M\&M Corp. has 8% coupon bonds on the market with 20 years to maturity. The bonds make semi-annual payments and currently sell for 107% of par. What is the YTM? What is the effective annual yield? Question 18 (2 points). Delta Corp. has bonds on the market with 15.5 years to maturity, a YTM of 7\%, and a current price of $1,045. The bonds make semi-annual payments. What must the coupon rate be on these bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts