Question: solve these please, thanks Question 12 ( 2 points). You have a sole proprietorship firm and are considering borrowing money for investment in working capital.

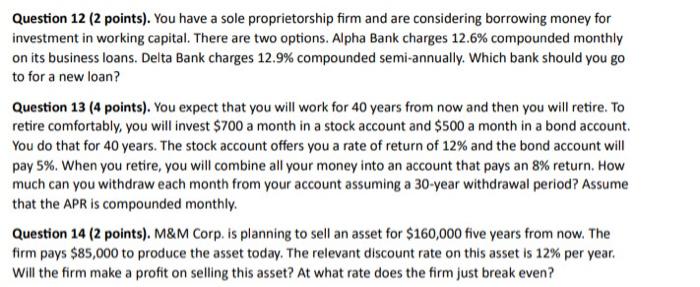

Question 12 ( 2 points). You have a sole proprietorship firm and are considering borrowing money for investment in working capital. There are two options. Alpha Bank charges 12.6% compounded monthly on its business loans. Delta Bank charges 12.9% compounded semi-annually. Which bank should you go to for a new loan? Question 13 ( 4 points). You expect that you will work for 40 years from now and then you will retire. To retire comfortably, you will invest $700 a month in a stock account and $500 a month in a bond account. You do that for 40 years. The stock account offers you a rate of return of 12% and the bond account will pay 5%. When you retire, you will combine all your money into an account that pays an 8% return. How much can you withdraw each month from your account assuming a 30-year withdrawal period? Assume that the APR is compounded monthly. Question 14 (2 points). M\&M Corp. is planning to sell an asset for $160,000 five years from now. The firm pays $85,000 to produce the asset today. The relevant discount rate on this asset is 12% per year. Will the firm make a profit on selling this asset? At what rate does the firm just break even

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts