Question: solve these problems:- In looking for ways to cut costs and increase profit (to make the company's stock go up), one of the company's industrial

solve these problems:-

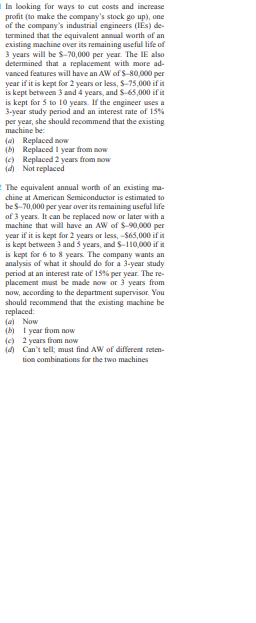

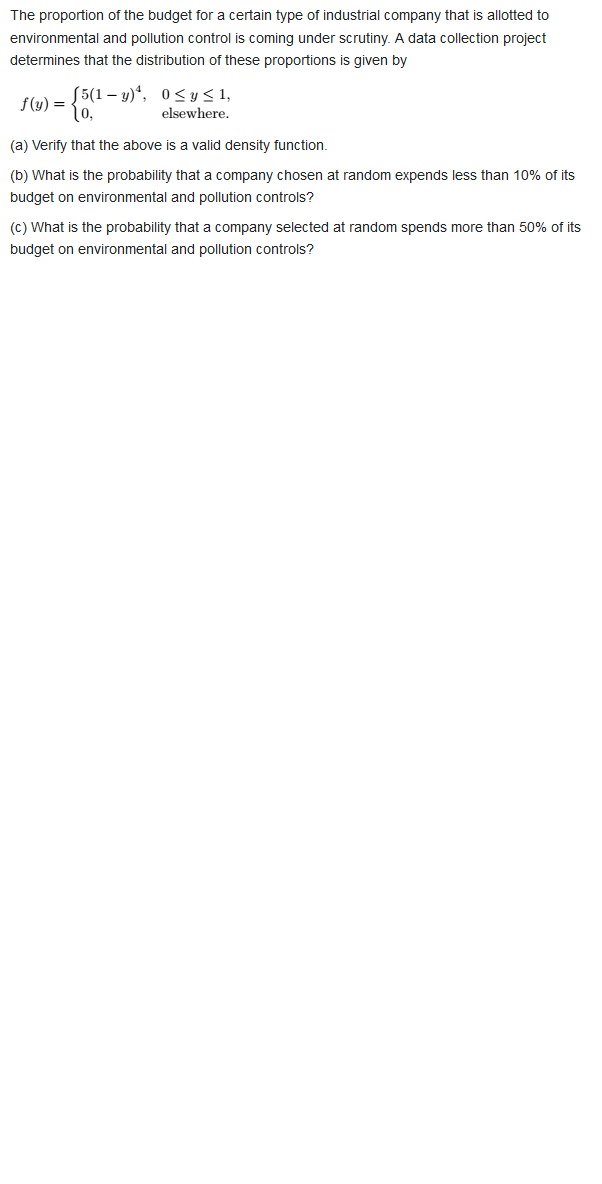

In looking for ways to cut costs and increase profit (to make the company's stock go up), one of the company's industrial engineers (IEs) de- termined that the equivalent annual worth of an existing machine over its remaining useful life of 3 years will be $-70,000 per year. The IE also determined that a replacement with more ad- vanced features will have an AW of $ 80,000 per year if it is kept for 2 years or less, $-75,000 if it is kept between 3 and 4 years, and $ 65,000 if it is kept for $ to 10 years. If the engineer uses a 3-year study period and an interest rate of 13% per year, she should recommend that the existing machine bbe: [a) Replaced now (5] Replaced I year from now (c) Replaced 2 years from now fa) Notreplaced The equivalent annual worth of an existing ma- chine at American Semiconductor is estimated to be $ 70,000 per year over its remaining useful life of 3 years. It can be replaced now or later with a machine that will have an AW of $ 90,000 per year if it is kept for 2 years or less, -$65,000 if it is kept between 3 and 3 years, and $-110,000 if it is kept for 6 to 8 years. The company wants an analysis of what it should do for a 3-year study period at an interest rate of 15% per year. The re- placement must be made now or 3 years from now, according to the department supervisor. You should recommend that the existing machine be replaced: (a) Now (5) 1 year from now (c) 2 years from now a) Can't tell; must find AW of different reten- tion combinations for the two machinesFor the last 2 years, The Health Company has experienced a fixed cost of $850,000 per year and an (r - v) value of $1.25 per unit for its multivitamin line of products. International competition has become severe enough that some financial changes must be made to keep market share at the current level. (a) Perform a spreadsheet-based graphical anal- ysis to estimate the effect on the breakeven point if the differen etween revenue and variable cost per unit somewhere between 1% and 15% of its current value. (b) If fixed costs and revenue per unit remain at their current values, what type of change must take place to make the breakeven point go down? (This is an extension of Problem 13.15) Expand the analysis performed in Problem 13.15 by chang- ing the variable cost per unit. The financial man- ager estimates that fixed costs will fall to $730,000 when the required production rate to break even is at or below 600,000 units. What happens to the breakeven points over the (r - v) range of 1%: to 13%% increase as evaluated previously?\f\f\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts