Question: Solve these with detailed calculation process, and explanation, please and thank you so much!!!! 1. Calculate the return on a stock that you bought at

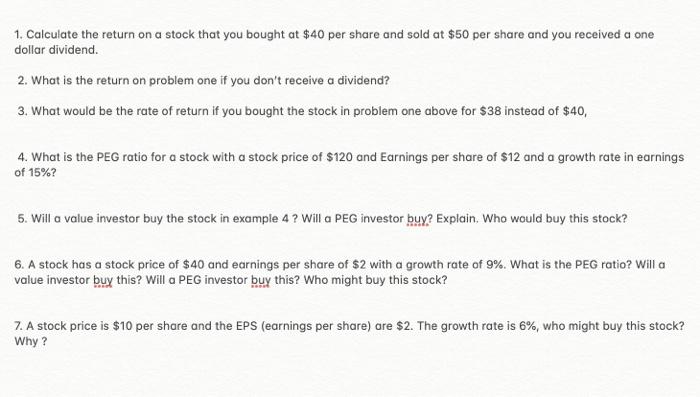

1. Calculate the return on a stock that you bought at $40 per share and sold at $50 per share and you received a one dollar dividend. 2. What is the return on problem one if you don't receive a dividend? 3. What would be the rate of return if you bought the stock in problem one above for $38 instead of $40, 4. What is the PEG ratio for a stock with a stock price of $120 and Earnings per share of $12 and a growth rate in earnings of 15%? 5. Will a value investor buy the stock in example 4 ? Will a PEG investor buy? Explain. Who would buy this stock? 6. A stock has a stock price of $40 and earnings per share of $2 with a growth rate of 9%. What is the PEG ratio? Willa value investor buy this? Will a PEG investor buy this? Who might buy this stock? 7. A stock price is $10 per share and the EPS (earnings per share) are $2. The growth rate is 6%, who might buy this stock? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts