Question: Solve this ABC costing question in detailed solution without any shortcuts! Profen Sdn.Bhd is an automotive component supplier. Profen Sdn. Bhd has been approached by

Solve this ABC costing question in detailed solution without any shortcuts!

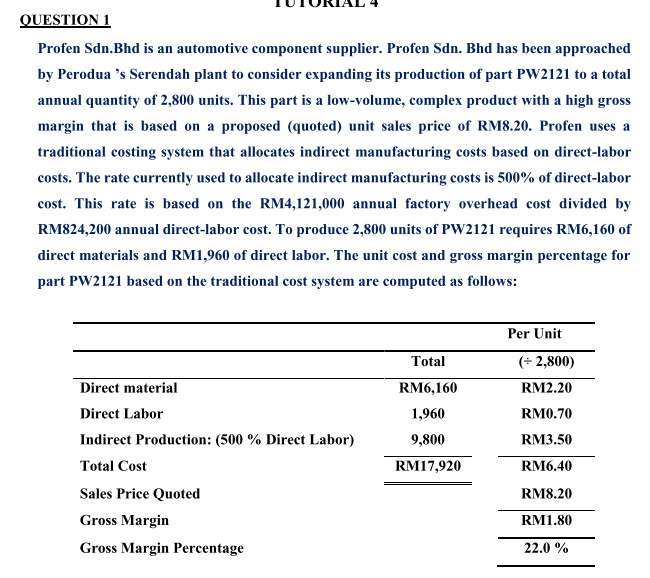

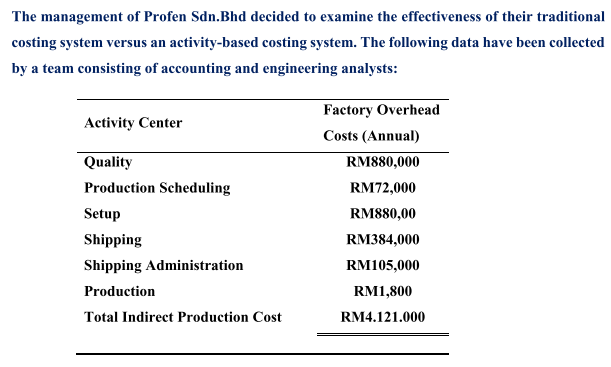

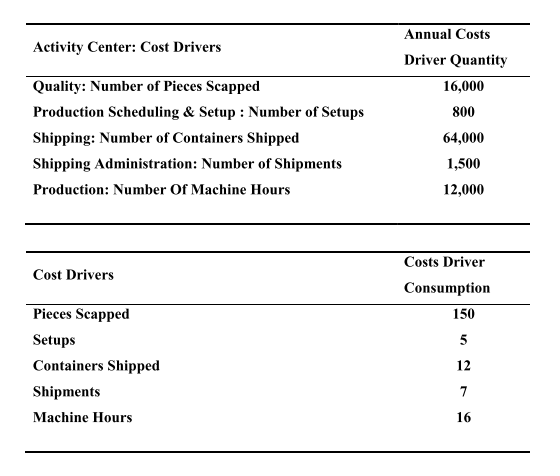

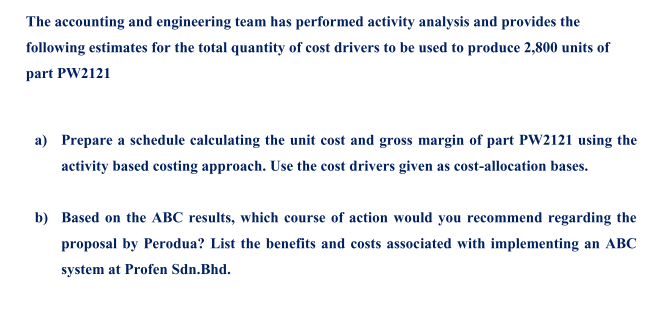

Profen Sdn.Bhd is an automotive component supplier. Profen Sdn. Bhd has been approached by Perodua 's Serendah plant to consider expanding its production of part PW2121 to a total annual quantity of 2,800 units. This part is a low-volume, complex product with a high gross margin that is based on a proposed (quoted) unit sales price of RM8.20. Profen uses a traditional costing system that allocates indirect manufacturing costs based on direct-labor costs. The rate currently used to allocate indirect manufacturing costs is 500% of direct-labor cost. This rate is based on the RM4,121,000 annual factory overhead cost divided by RM824,200 annual direct-labor cost. To produce 2,800 units of PW2121 requires RM6,160 of direct materials and RM1,960 of direct labor. The unit cost and gross margin percentage for part PW2121 based on the traditional cost system are computed as follows: The management of Profen Sdn.Bhd decided to examine the effectiveness of their traditional costing system versus an activity-based costing system. The following data have been collected by a team consisting of accounting and engineering analysts: \begin{tabular}{lc} \hline Activity Center: Cost Drivers & Annual Costs Driver Quantity \\ \hline Quality: Number of Pieces Scapped & 16,000 \\ Production Scheduling \& Setup : Number of Setups & 800 \\ Shipping: Number of Containers Shipped & 64,000 \\ Shipping Administration: Number of Shipments & 1,500 \\ Production: Number Of Machine Hours & 12,000 \\ \hline & Costs Driver \\ \hline Cost Drivers & Consumption \\ \hline Pieces Scapped & 150 \\ Setups & 5 \\ Containers Shipped & 12 \\ Shipments & 7 \\ Machine Hours & \\ \hline \end{tabular} The accounting and engineering team has performed activity analysis and provides the following estimates for the total quantity of cost drivers to be used to produce 2,800 units of part PW2121 a) Prepare a schedule calculating the unit cost and gross margin of part PW2121 using the activity based costing approach. Use the cost drivers given as cost-allocation bases. b) Based on the ABC results, which course of action would you recommend regarding the proposal by Perodua? List the benefits and costs associated with implementing an ABC system at Profen Sdn.Bhd. Profen Sdn.Bhd is an automotive component supplier. Profen Sdn. Bhd has been approached by Perodua 's Serendah plant to consider expanding its production of part PW2121 to a total annual quantity of 2,800 units. This part is a low-volume, complex product with a high gross margin that is based on a proposed (quoted) unit sales price of RM8.20. Profen uses a traditional costing system that allocates indirect manufacturing costs based on direct-labor costs. The rate currently used to allocate indirect manufacturing costs is 500% of direct-labor cost. This rate is based on the RM4,121,000 annual factory overhead cost divided by RM824,200 annual direct-labor cost. To produce 2,800 units of PW2121 requires RM6,160 of direct materials and RM1,960 of direct labor. The unit cost and gross margin percentage for part PW2121 based on the traditional cost system are computed as follows: The management of Profen Sdn.Bhd decided to examine the effectiveness of their traditional costing system versus an activity-based costing system. The following data have been collected by a team consisting of accounting and engineering analysts: \begin{tabular}{lc} \hline Activity Center: Cost Drivers & Annual Costs Driver Quantity \\ \hline Quality: Number of Pieces Scapped & 16,000 \\ Production Scheduling \& Setup : Number of Setups & 800 \\ Shipping: Number of Containers Shipped & 64,000 \\ Shipping Administration: Number of Shipments & 1,500 \\ Production: Number Of Machine Hours & 12,000 \\ \hline & Costs Driver \\ \hline Cost Drivers & Consumption \\ \hline Pieces Scapped & 150 \\ Setups & 5 \\ Containers Shipped & 12 \\ Shipments & 7 \\ Machine Hours & \\ \hline \end{tabular} The accounting and engineering team has performed activity analysis and provides the following estimates for the total quantity of cost drivers to be used to produce 2,800 units of part PW2121 a) Prepare a schedule calculating the unit cost and gross margin of part PW2121 using the activity based costing approach. Use the cost drivers given as cost-allocation bases. b) Based on the ABC results, which course of action would you recommend regarding the proposal by Perodua? List the benefits and costs associated with implementing an ABC system at Profen Sdn.Bhd

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts