Question: solve this calculation QUESTION 2 (20 MARKS) (a) Along company is expected to pay dividends of RM0.18 to its company's ordinary shareholders next year and

solve this calculation

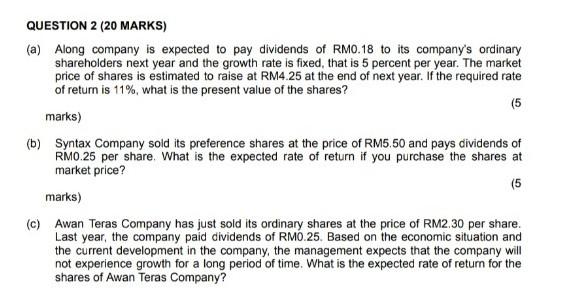

QUESTION 2 (20 MARKS) (a) Along company is expected to pay dividends of RM0.18 to its company's ordinary shareholders next year and the growth rate is fixed, that is 5 percent per year. The market price of shares is estimated to raise at RM4.25 at the end of next year. If the required rate of retum is 11%, what is the present value of the shares? marks) (5 (b) Syntax Company sold its preference shares at the price of RM5.50 and pays dividends of RM0.25 per share. What is the expected rate of return if you purchase the shares at market price? (5 marks) (c) Awan Teras Company has just sold its ordinary shares at the price of RM2.30 per share. Last year, the company paid dividends of RM0.25. Based on the economic situation and the current development in the company, the management expects that the company will not experience growth for a long period of time. What is the expected rate of return for the shares of Awan Teras Company? QUESTION 2 (20 MARKS) (a) Along company is expected to pay dividends of RM0.18 to its company's ordinary shareholders next year and the growth rate is fixed, that is 5 percent per year. The market price of shares is estimated to raise at RM4.25 at the end of next year. If the required rate of retum is 11%, what is the present value of the shares? marks) (5 (b) Syntax Company sold its preference shares at the price of RM5.50 and pays dividends of RM0.25 per share. What is the expected rate of return if you purchase the shares at market price? (5 marks) (c) Awan Teras Company has just sold its ordinary shares at the price of RM2.30 per share. Last year, the company paid dividends of RM0.25. Based on the economic situation and the current development in the company, the management expects that the company will not experience growth for a long period of time. What is the expected rate of return for the shares of Awan Teras Company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts