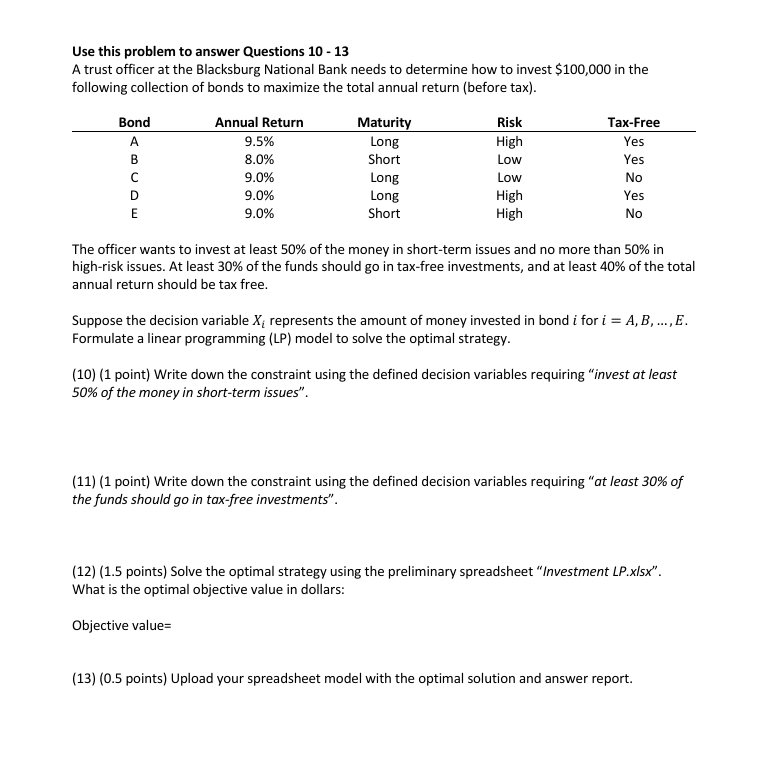

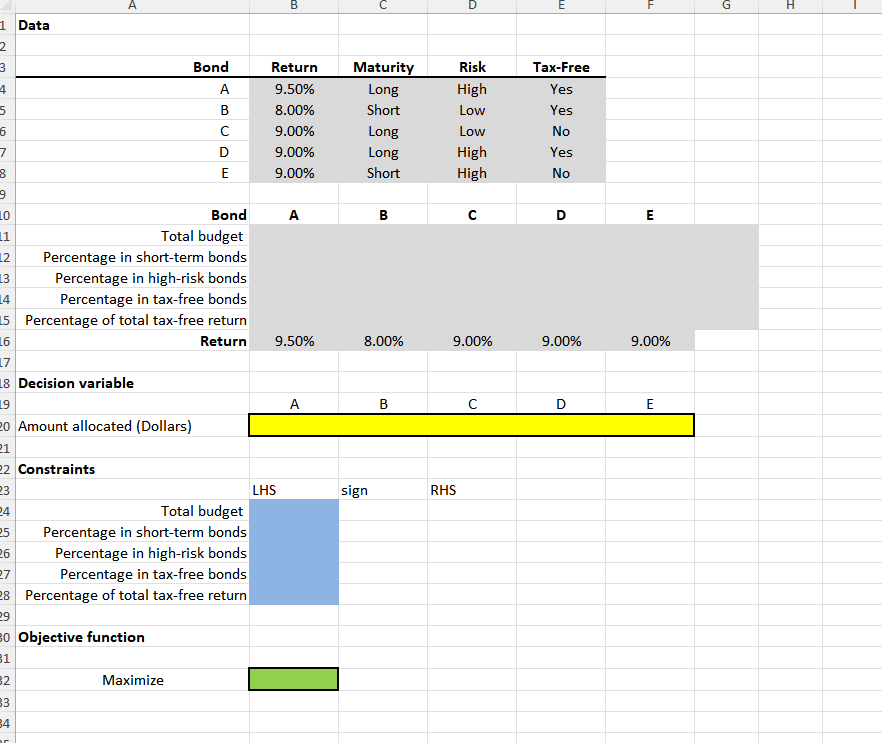

Question: Solve this in excel using the provide template, answer the questions and guide me how to set it up in excel. Use this problem to

Solve this in excel using the provide template, answer the questions and guide me how to set it up in excel.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts