Question: solve this not in excel but by hand and explain every step please Problem - Write your answer in the space provided below. 44) The

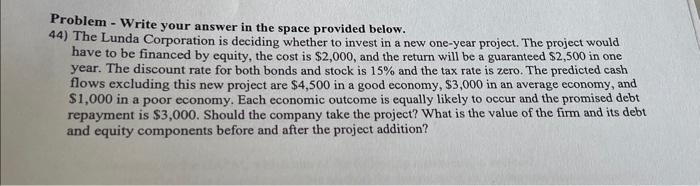

Problem - Write your answer in the space provided below. 44) The Lunda Corporation is deciding whether to invest in a new one-year project. The project would have to be financed by equity, the cost is $2,000, and the return will be a guaranteed $2,500 in one year. The discount rate for both bonds and stock is 15% and the tax rate is zero. The predicted cash flows excluding this new project are $4,500 in a good economy, $3,000 in an average economy, and $1,000 in a poor economy. Each economic outcome is equally likely to occur and the promised debt repayment is $3,000. Should the company take the project? What is the value of the firm and its debt and equity components before and after the project addition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts