Question: solve this one MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question.[10 * 1 Mark =10 Marks]. Max. Time:

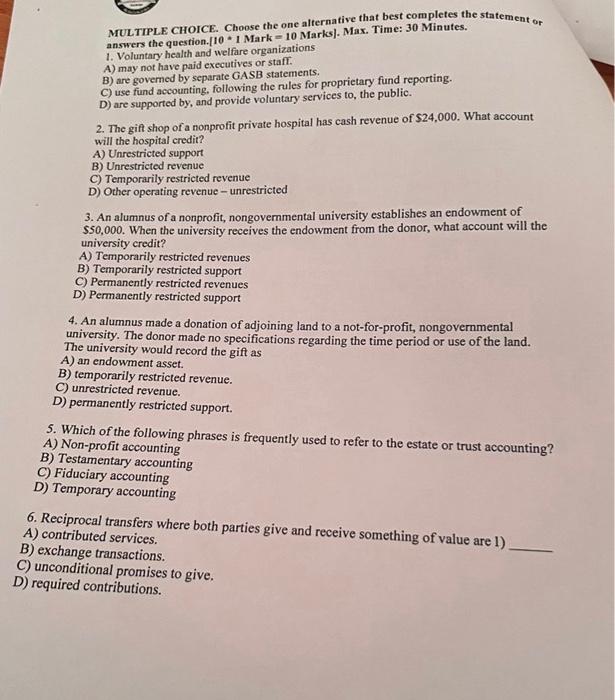

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question.[10 * 1 Mark =10 Marks]. Max. Time: 30 Minutes. 1. Voluntary health and welfare organizations A) may not have paid executives or staff. B) are governed by separate GASB statements. C) use fund accounting, following the rules for proprietary fund reporting. D) are supported by, and provide voluntary services to, the public. 2. The gift shop of a nonprofit private hospital has cash revenue of $24,000. What account will the hospital credit? A) Unrestricted support B) Unrestricted revenue C) Temporarily restricted revenue D) Other operating revenue - unrestricted 3. An alumnus of a nonprofit, nongovernmental university establishes an endowment of $50,000. When the university receives the endowment from the donor, what account will the university credit? A) Temporarily restricted revenues B) Temporarily restricted support C) Permanently restricted revenues D) Permanently restricted support 4. An alumnus made a donation of adjoining land to a not-for-profit, nongovernmental university. The donor made no specifications regarding the time period or use of the land. The university would record the gift as A) an endowment asset. B) temporarily restricted revenue. C) unrestricted revenue. D) permanently restricted support. 5. Which of the following phrases is frequently used to refer to the estate or trust accounting? A) Non-profit accounting B) Testamentary accounting C) Fiduciary accounting D) Temporary accounting 6. Reciprocal transfers where both parties give and receive something of value are 1) A) contributed services. B) exchange transactions. C) unconditional promises to give. D) required contributions. MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question.[10 * 1 Mark =10 Marks]. Max. Time: 30 Minutes. 1. Voluntary health and welfare organizations A) may not have paid executives or staff. B) are governed by separate GASB statements. C) use fund accounting, following the rules for proprietary fund reporting. D) are supported by, and provide voluntary services to, the public. 2. The gift shop of a nonprofit private hospital has cash revenue of $24,000. What account will the hospital credit? A) Unrestricted support B) Unrestricted revenue C) Temporarily restricted revenue D) Other operating revenue - unrestricted 3. An alumnus of a nonprofit, nongovernmental university establishes an endowment of $50,000. When the university receives the endowment from the donor, what account will the university credit? A) Temporarily restricted revenues B) Temporarily restricted support C) Permanently restricted revenues D) Permanently restricted support 4. An alumnus made a donation of adjoining land to a not-for-profit, nongovernmental university. The donor made no specifications regarding the time period or use of the land. The university would record the gift as A) an endowment asset. B) temporarily restricted revenue. C) unrestricted revenue. D) permanently restricted support. 5. Which of the following phrases is frequently used to refer to the estate or trust accounting? A) Non-profit accounting B) Testamentary accounting C) Fiduciary accounting D) Temporary accounting 6. Reciprocal transfers where both parties give and receive something of value are 1) A) contributed services. B) exchange transactions. C) unconditional promises to give. D) required contributions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts