Question: solve this please Question 6 (8 points) Lennon's Brew Pub has decided to acquire a new Fermention system. The cost is $80,000 and in four

solve this please

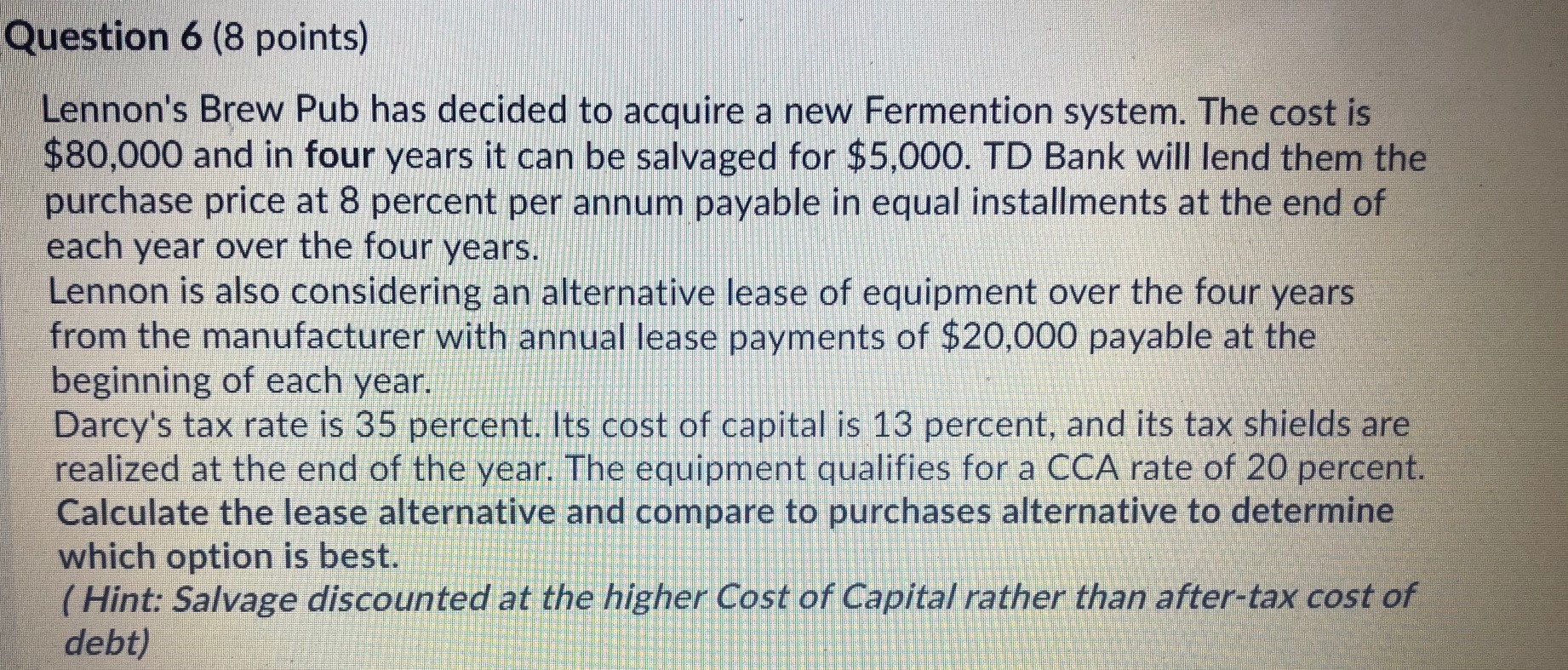

Question 6 (8 points) Lennon's Brew Pub has decided to acquire a new Fermention system. The cost is $80,000 and in four years it can be salvaged for $5,000. TD Bank will lend them the purchase price at 8 percent per annum payable in equal installments at the end of each year over the four years. Lennon is also considering an alternative lease of equipment over the four years from the manufacturer with annual lease payments of $20,000 payable at the beginning of each year. Darcy's tax rate is 35 percent. Its cost of capital is 13 percent, and its tax shields are realized at the end of the year. The equipment qualifies for a CCA rate of 20 percent. Calculate the lease alternative and compare to purchases alternative to determine which option is best. ( Hint: Salvage discounted at the higher Cost of Capital rather than after-tax cost of debt)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts