Question: Solve this problem 1.Consider a consumer who starts his economic life at the age of 26. He will work for 40 years and retire at

Solve this problem

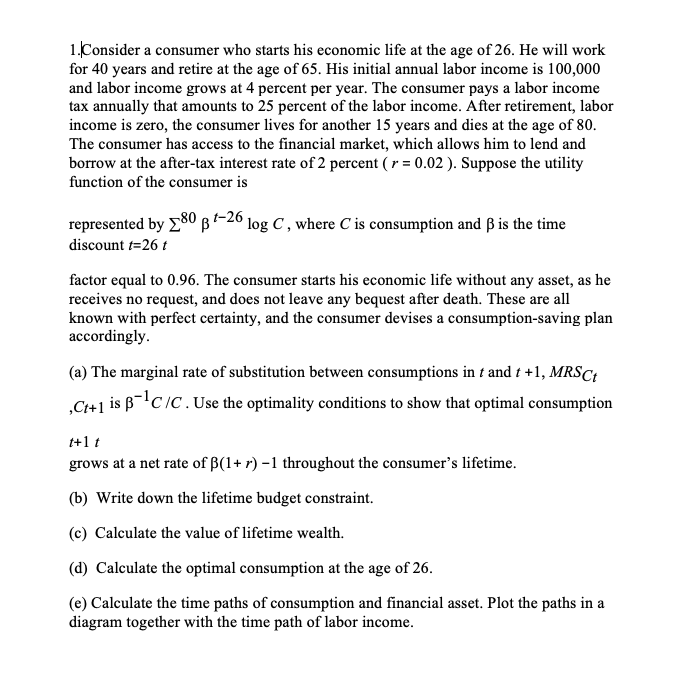

1.Consider a consumer who starts his economic life at the age of 26. He will work for 40 years and retire at the age of 65. His initial annual labor income is 100,000 and labor income grows at 4 percent per year. The consumer pays a labor income tax annually that amounts to 25 percent of the labor income. After retirement, labor income is zero, the consumer lives for another 15 years and dies at the age of 80. The consumer has access to the financial market, which allows him to lend and borrow at the after-tax interest rate of 2 percent ( r = 0.02 ). Suppose the utility function of the consumer is represented by 280 p -20 log C, where C is consumption and B is the time discount t=26 t factor equal to 0.96. The consumer starts his economic life without any asset, as he receives no request, and does not leave any bequest after death. These are all known with perfect certainty, and the consumer devises a consumption-saving plan accordingly. (a) The marginal rate of substitution between consumptions in t and t +1, MRSC ,Ct+1 is B"C/C. Use the optimality conditions to show that optimal consumption t+1 t grows at a net rate of B(1+ r) -1 throughout the consumer's lifetime. (b) Write down the lifetime budget constraint. (c) Calculate the value of lifetime wealth. (d) Calculate the optimal consumption at the age of 26. (e) Calculate the time paths of consumption and financial asset. Plot the paths in a diagram together with the time path of labor income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts