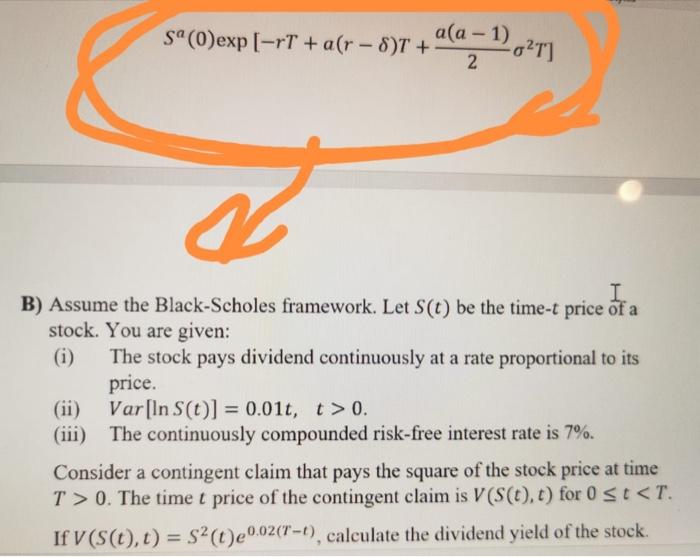

Question: solve this problem by using that the equation above this equation give us the price of contingency claim. a(a - 1) oT] S(O)exp [-r1 +

a(a - 1) oT] S(O)exp [-r1 + a(r - 8)T + 2 a I B) Assume the Black-Scholes framework. Let S(t) be the time-t price of a stock. You are given: The stock pays dividend continuously at a rate proportional to its price. (ii) Var[In S(t)] = 0.01t, t > 0. (iii) The continuously compounded risk-free interest rate is 7%. Consider a contingent claim that pays the square of the stock price at time T > 0. The time t price of the contingent claim is V(S(t),t) for 0 St

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts