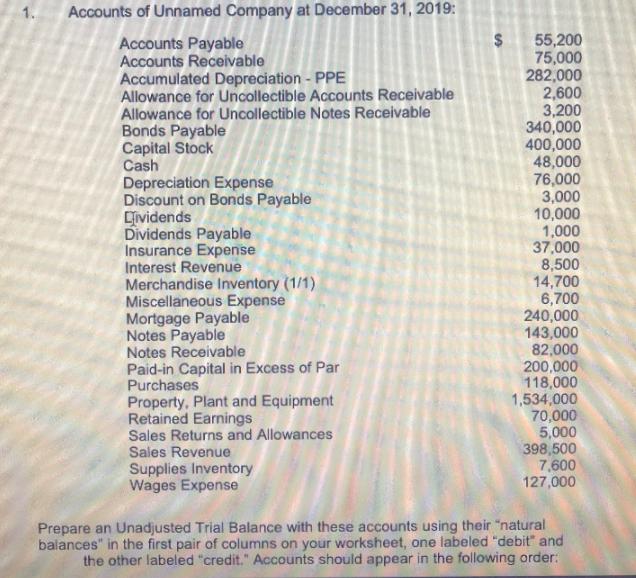

Question: 1. Accounts of Unnamed Company at December 31, 2019: 2$ Accounts Payable Accounts Receivable Accumulated Depreciation - PPE Allowance for Uncollectible Accounts Receivable Allowance

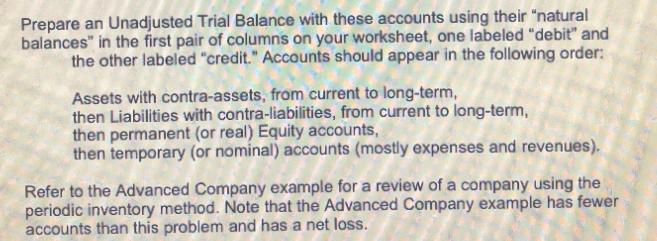

1. Accounts of Unnamed Company at December 31, 2019: 2$ Accounts Payable Accounts Receivable Accumulated Depreciation - PPE Allowance for Uncollectible Accounts Receivable Allowance for Uncollectible Notes Receivable Bonds Payable Capital Stock Cash Depreciation Expense Discount on Bonds Payable Cividends Dividends Payable Insurance Expense Interest Revenue Merchandise Inventory (1/1) Miscellaneous Expense Mortgage Payable Notes Payable Notes Receivable Paid-in Capital in Excess of Par Purchases Property, Plant and Equipment Retained Earnings Sales Returns and Allowances Sales Revenue Supplies Inventory Wages Expense 55,200 75,000 282,000 2,600 3,200 340,000 400,000 48,000 76,000 3,000 10,000 1,000 37,000 8,500 14,700 6,700 240,000 143,000 82,000 200,000 118,000 1,534,000 70,000 5,000 398,500 7,600 127,000 Prepare an Unadjusted Trial Balance with these accounts using their "natural balances" in the first pair of columns on your worksheet, one labeled "debit" and the other labeled "credit." Accounts should appear in the following order: Prepare an Unadjusted Trial Balance with these accounts using their "natural balances" in the first pair of columns on your worksheet, one labeled "debit" and the other labeled "credit." Accounts should appear in the following order: Assets with contra-assets, from current to long-term, then Liabilities with contra-liabilities, from current to long-term, then permanent (or real) Equity accounts, then temporary (or nominal) accounts (mostly expenses and revenues). Refer to the Advanced Company example for a review of a company using the periodic inventory method. Note that the Advanced Company example has fewer accounts than this problem and has a net loss.

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts