Question: Solve this problem using the attached formula - An employee's compensation includes an annuity with 8 annual payments that pays $75,000 at retirement, with each

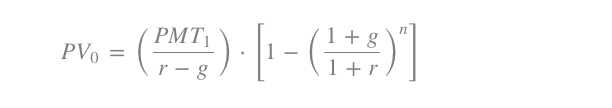

Solve this problem using the attached formula - An employee's compensation includes an annuity with 8 annual payments that pays $75,000 at retirement, with each subsequent payment growing by 2%. The firm's policy is to pre-fund such annuities one year before retirement. At an interest rate of 5%, how much would the firm need to invest?Equivalent problem structure (in neutral time-value-of-money terms): What is the present value of a series of payments received each year for 8 years, starting with $75,000 paid one year from now and the payment growing in each subsequent year by 2%? Assume a discount rate of 5%.Please round your answer to the nearest hundredth.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts