Question: Solve this problem with steps by steps A.1)We know that the yen and the swiss franc have a 120yen/ sf 1 exchange rate, meaning one

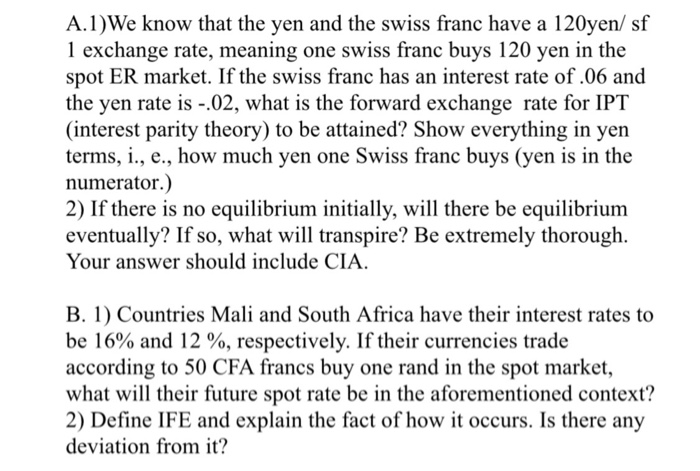

A.1)We know that the yen and the swiss franc have a 120yen/ sf 1 exchange rate, meaning one swiss franc buys 120 yen in the spot ER market. If the swiss franc has an interest rate of .06 and the yen rate is -.02, what is the forward exchange rate for IPT (interest parity theory) to be attained? Show everything in yen terms, i., e., how much yen one Swiss franc buys (yen is in the numerator.) 2) If there is no equilibrium initially, will there be equilibrium eventually? If so, what will transpire? Be extremely thorough. Your answer should include CIA. B. 1) Countries Mali and South Africa have their interest rates to be 16% and 12 %, respectively. If their currencies trade according to 50 CFA francs buy one rand in the spot market, what will their future spot rate be in the aforementioned context? 2) Define IFE and explain the fact of how it occurs. Is there any deviation from it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts