Question: solve this question im stuck in the question Using excel create a data base for the Food and Beverage department at Reggae Foods Ltd. The

solve this question im stuck in the question

solve this question im stuck in the question

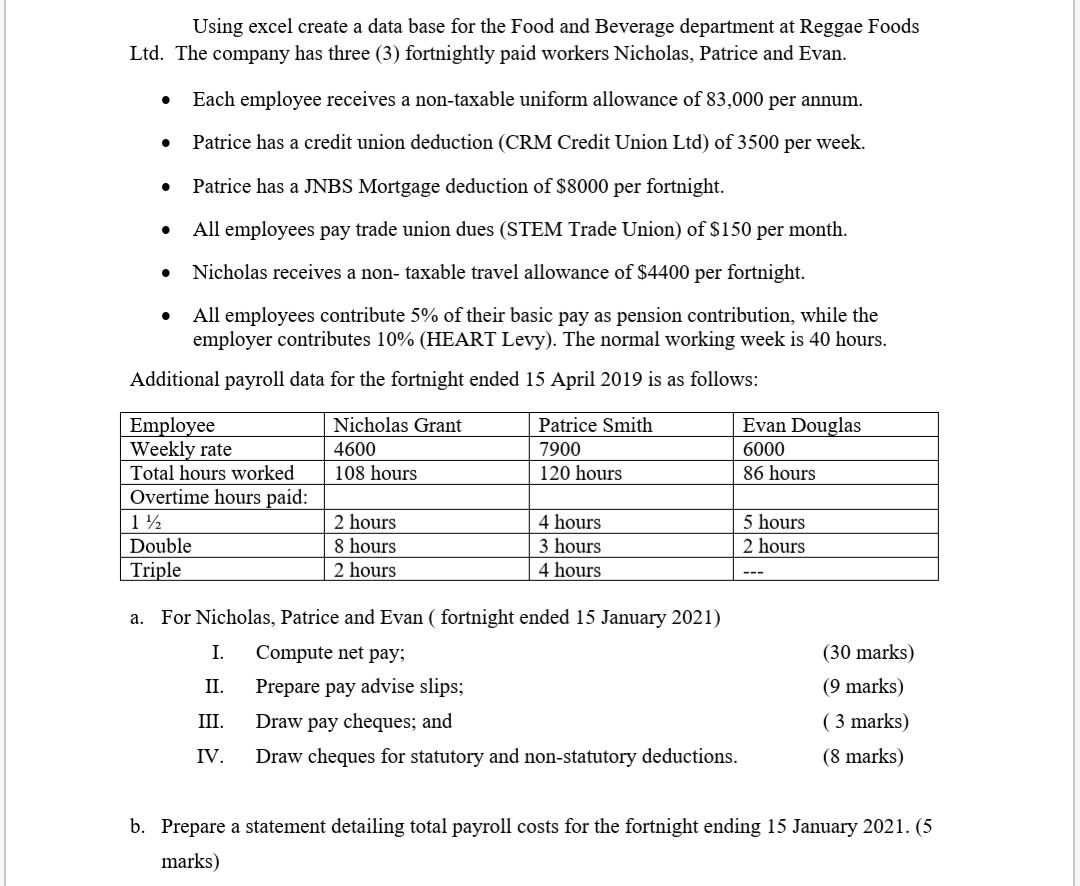

Using excel create a data base for the Food and Beverage department at Reggae Foods Ltd. The company has three (3) fortnightly paid workers Nicholas, Patrice and Evan. Each employee receives a non-taxable uniform allowance of 83,000 per annum. Patrice has a credit union deduction (CRM Credit Union Ltd) of 3500 per week. Patrice has a JNBS Mortgage deduction of $8000 per fortnight. . All employees pay trade union dues (STEM Trade Union) of $150 per month. Nicholas receives a non-taxable travel allowance of $4400 per fortnight. . All employees contribute 5% of their basic pay as pension contribution, while the employer contributes 10% (HEART Levy). The normal working week is 40 hours. Additional payroll data for the fortnight ended 15 April 2019 is as follows: Employee Weekly rate Total hours worked Overtime hours paid: Nicholas Grant 4600 108 hours Patrice Smith 7900 120 hours Evan Douglas 6000 86 hours 2 hours 8 hours 2 hours Double Triple 4 hours 3 hours 4 hours 5 hours 2 hours a. For Nicholas, Patrice and Evan ( fortnight ended 15 January 2021) I. Compute net pay; II. Prepare pay advise slips; III. Draw pay cheques; and IV. Draw cheques for statutory and non-statutory deductions. (30 marks) (9 marks) (3 marks) (8 marks) b. Prepare a statement detailing total payroll costs for the fortnight ending 15 January 2021. (5 marks) Using excel create a data base for the Food and Beverage department at Reggae Foods Ltd. The company has three (3) fortnightly paid workers Nicholas, Patrice and Evan. Each employee receives a non-taxable uniform allowance of 83,000 per annum. Patrice has a credit union deduction (CRM Credit Union Ltd) of 3500 per week. Patrice has a JNBS Mortgage deduction of $8000 per fortnight. . All employees pay trade union dues (STEM Trade Union) of $150 per month. Nicholas receives a non-taxable travel allowance of $4400 per fortnight. . All employees contribute 5% of their basic pay as pension contribution, while the employer contributes 10% (HEART Levy). The normal working week is 40 hours. Additional payroll data for the fortnight ended 15 April 2019 is as follows: Employee Weekly rate Total hours worked Overtime hours paid: Nicholas Grant 4600 108 hours Patrice Smith 7900 120 hours Evan Douglas 6000 86 hours 2 hours 8 hours 2 hours Double Triple 4 hours 3 hours 4 hours 5 hours 2 hours a. For Nicholas, Patrice and Evan ( fortnight ended 15 January 2021) I. Compute net pay; II. Prepare pay advise slips; III. Draw pay cheques; and IV. Draw cheques for statutory and non-statutory deductions. (30 marks) (9 marks) (3 marks) (8 marks) b. Prepare a statement detailing total payroll costs for the fortnight ending 15 January 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts