Question: Solve this Question in Excle , Show me step by step to understand Question 2 Sohar International is considering two major projects. The firm has

Solve this Question in Excle , Show me step by step to understand

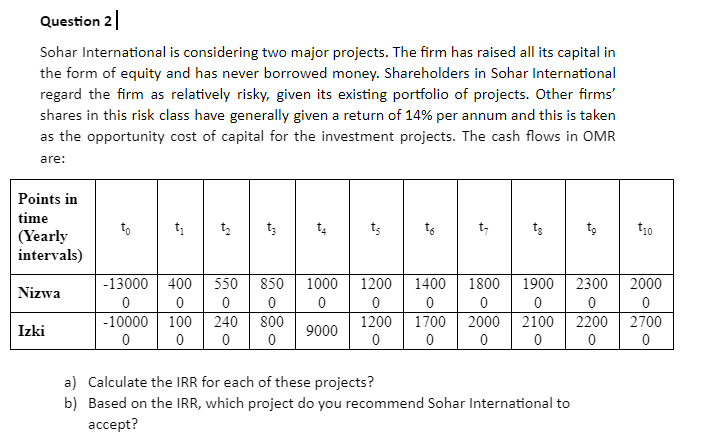

Question 2 Sohar International is considering two major projects. The firm has raised all its capital in the form of equity and has never borrowed money. Shareholders in Sohar International regard the firm as relatively risky, given its existing portfolio of projects. Other firms' shares in this risk class have generally given a return of 14% per annum and this is taken as the opportunity cost of capital for the investment projects. The cash flows in OMR are: Points in time (Yearly intervals) to ti ta tz t4 ts ts to t10 1000 1400 1800 1900 2300 Nizwa -13000 400 0 -10000 100 0 0 550 0 240 0 850 0 800 0 1200 0 1200 0 2000 0 2700 0 Izki 9000 1700 0 2000 0 2100 0 2200 0 a) Calculate the IRR for each of these projects? b) Based on the IRR, which project do you recommend Sohar International to accept

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts