Question: Solve this question on PAPER as soon as possible i'll surely give u Thumbs up. Note the following Information. A line of credit is an

Solve this question on PAPER as soon as possible i'll surely give u Thumbs up.

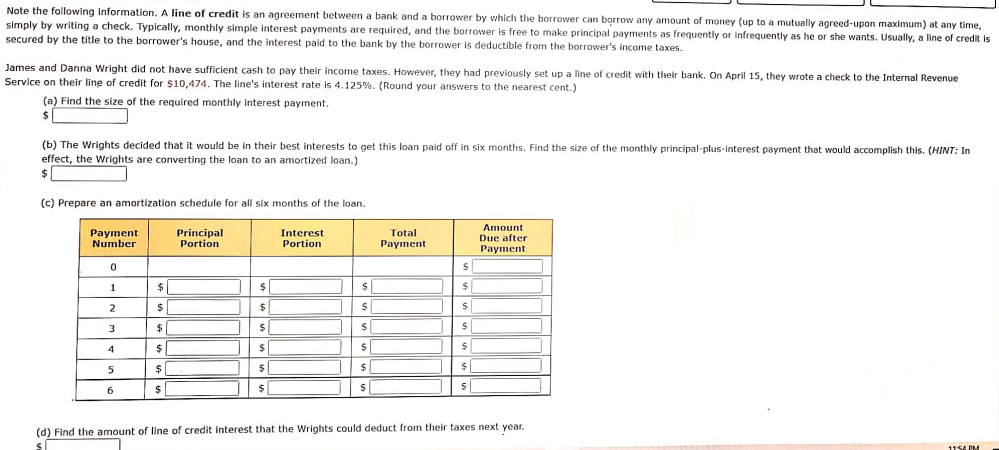

Note the following Information. A line of credit is an agreement between a bank and a borrower by which the borrower can borrow any amount of money (up to a mutually agreed-upon maximum) at any time, simply by writing a check. Typically, monthly simple interest payments are required, and the borrower is free to make principal payments as frequently or infrequently as he or she wants. Usually, a line of credit is secured by the title to the borrower's house, and the interest paid to the bank by the borrower is deductible from the borrower's income taxes. James and Danna Wright did not have sufficient cash to pay their income taxes. However, they had previously set up a line of credit with their bank. On April 15, they wrote a check to the Internal Revenue Service on their line of credit for $10,474. The line's interest rate is 4.125%. (Round your answers to the nearest cent.) (a) Find the size of the required monthly interest payment. $ (b) The Wrights decided that it would be in their best interests to get this loan paid off in six months. Find the size of the monthly principal plus interest payment that would accomplish this. (HINT: In effect, the Wrights are converting the loan to an amortized loan.) $ (c) Prepare an amortization schedule for all six months of the loan. Payment Number Principal Portion Interest Portion Total Payment Amount Due after Payment 0 s 1 $ $ $ $1 $ 2 $ $ $ 3 $ $ $ $ $ $ $ $ 4 $ 5 $ $ 6 $ $ $ 5 (d) Find the amount of line of credit interest that the Wrights could deduct from their taxes next year. 11:54 PM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts