Question: Solve this with relevant working Consider the following information about a non-dividend paying stock. $55 Current Stock Price St Return Standard Deviation Dividend Rate 40%

Solve this with relevant working

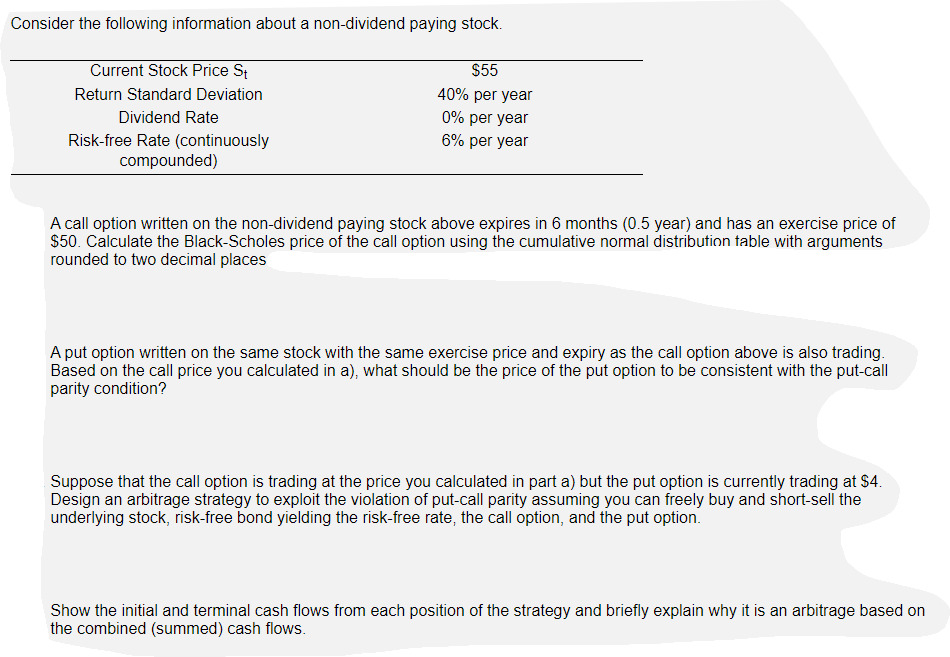

Consider the following information about a non-dividend paying stock. $55 Current Stock Price St Return Standard Deviation Dividend Rate 40% per year 0% per year 6% per year Risk-free Rate (continuously compounded) A call option written on the non-dividend paying stock above expires in 6 months (0.5 year) and has an exercise price of $50. Calculate the Black-Scholes price of the call option using the cumulative normal distribution table with arguments rounded to two decimal places A put option written on the same stock with the same exercise price and expiry as the call option above is also trading. Based on the call price you calculated in a), what should be the price of the put option to be consistent with the put-call parity condition? Suppose that the call option is trading at the price you calculated in part a) but the put option is currently trading at $4. Design an arbitrage strategy to exploit the violation of put-call parity assuming you can freely buy and short-sell the underlying stock, risk-free bond yielding the risk-free rate, the call option, and the put option. Show the initial and terminal cash flows from each position of the strategy and briefly explain why it is an arbitrage based on the combined (summed) cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts