Question: Solve this with Stata. Dataset is given. Pls check. Question 3: GARCH Model Selection [25 marks] The dataset is the same as in Question 2.

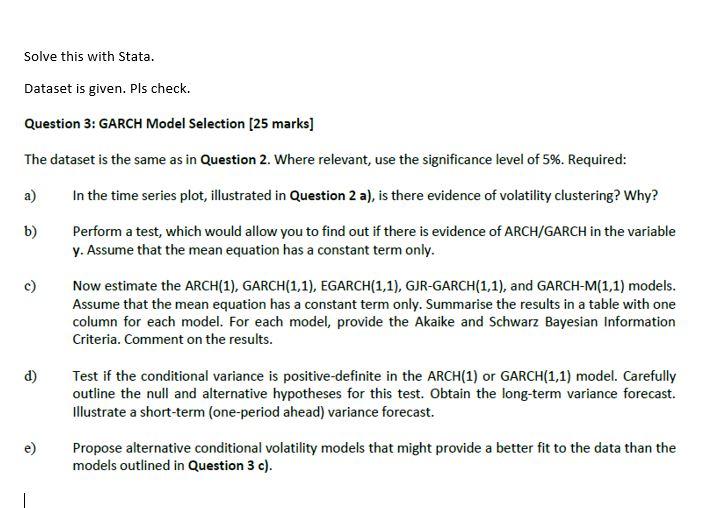

Solve this with Stata. Dataset is given. Pls check. Question 3: GARCH Model Selection [25 marks] The dataset is the same as in Question 2. Where relevant, use the significance level of 5%. Required: a) In the time series plot, illustrated in Question 2 a), is there evidence of volatility clustering? Why? b) Perform a test, which would allow you to find out if there is evidence of ARCH/GARCH in the variable y. Assume that the mean equation has a constant term only. c) Now estimate the ARCH(1), GARCH(1,1), EGARCH(1,1), GJR-GARCH(1,1), and GARCH-M(1,1) models. Assume that the mean equation has a constant term only. Summarise the results in a table with one column for each model. For each model, provide the Akaike and Schwarz Bayesian Information Criteria. Comment on the results. d) Test if the conditional variance is positive-definite in the ARCH(1) or GARCH(1,1) model. Carefully outline the null and alternative hypotheses for this test. Obtain the long-term variance forecast. Illustrate a short-term (one-period ahead) variance forecast. e) Propose alternative conditional volatility models that might provide a better fit to the data than the models outlined in Question 3 c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts