Question: Solve using a spreadsheet program such as Excel. B. Solve using a financial calculator (optional). Refer to Problem 2-28 at the end of Chapter 2.

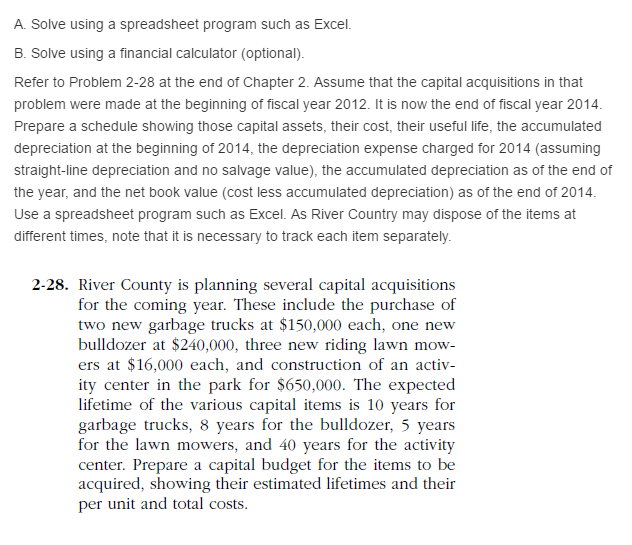

Solve using a spreadsheet program such as Excel. B. Solve using a financial calculator (optional). Refer to Problem 2-28 at the end of Chapter 2. Assume that the capital acquisitions in that problem were made at the beginning of fiscal year 2012. It is now the end of fiscal year 2014. Prepare a schedule showing those capital assets, their cost, their useful life, the accumulated depreciation at the beginning of 2014, the depreciation expense charged for 2014 (assuming straight-line depreciation and no salvage value), the accumulated depreciation as of the end of the year, and the net book value (cost less accumulated depreciation) as of the end of 2014. Use a spreadsheet program such as Excel. As River Country may dispose of the items at different times, note that it is necessary to track each item separately. River County is planning several capital acquisitions for the coming year. These include the purchase of two new garbage trucks at $150,000 each, one new bulldozer at $240,000, three new riding lawn mowers at $16,000 each, and construction of an activity center in the park for $650,000. The expected lifetime of the various capital items is 10 years for garbage trucks, 8 years for the bulldozer, 5 years for the lawn mowers, and 40 years for the activity center. Prepare a capital budget for the items to be acquired, showing their estimated lifetimes and their per unit and total costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts