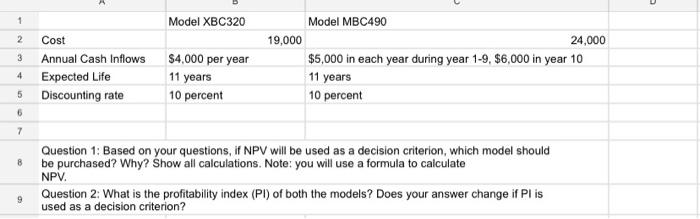

Question: Solve using excel. 1 Model XBC320 2 3 Cost Annual Cash Inflows Expected Life Discounting rate 4 Model MBC490 19,000 24,000 $5,000 in each year

1 Model XBC320 2 3 Cost Annual Cash Inflows Expected Life Discounting rate 4 Model MBC490 19,000 24,000 $5,000 in each year during year 1-9, $6,000 in year 10 11 years 10 percent $4,000 per year 11 years 10 percent 5 6 7 8 Question 1: Based on your questions, if NPV will be used as a decision criterion, which model should be purchased? Why? Show all calculations. Note: you will use a formula to calculate NPV. Question 2: What is the profitability index (Pl) of both the models? Does your answer change if Pl is used as a decision criterion? 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts