Question: SOLVE USING EXCEL. A company is considering estimating its stock price using the Pro Forma method combined with the Discounted Cash Flow ( DCF )

SOLVE USING EXCEL. A company is considering estimating its stock price using the Pro Forma method combined with the Discounted Cash Flow DCF model. The following financial projections for the next five years are provided:

Year : Revenue: $; EBIT: $; Depreciation: $; Capital Expenditures: $; Change in Working Capital: $

Year : Revenue: $; EBIT: $; Depreciation: $; Capital Expenditures: $; Change in Working Capital: $

Year : Revenue: $; EBIT: $; Depreciation: $; Capital Expenditures: $; Change in Working Capital: $

Year : Revenue: $; EBIT: $; Depreciation: $; Capital Expenditures: $; Change in Working Capital: $

Year : Revenue: $; EBIT: $; Depreciation: $; Capital Expenditures: $; Change in Working Capital: $

Additional information:

Tax rate:

WACC:

Terminal growth rate after Year :

Current debt: $

Cash: $

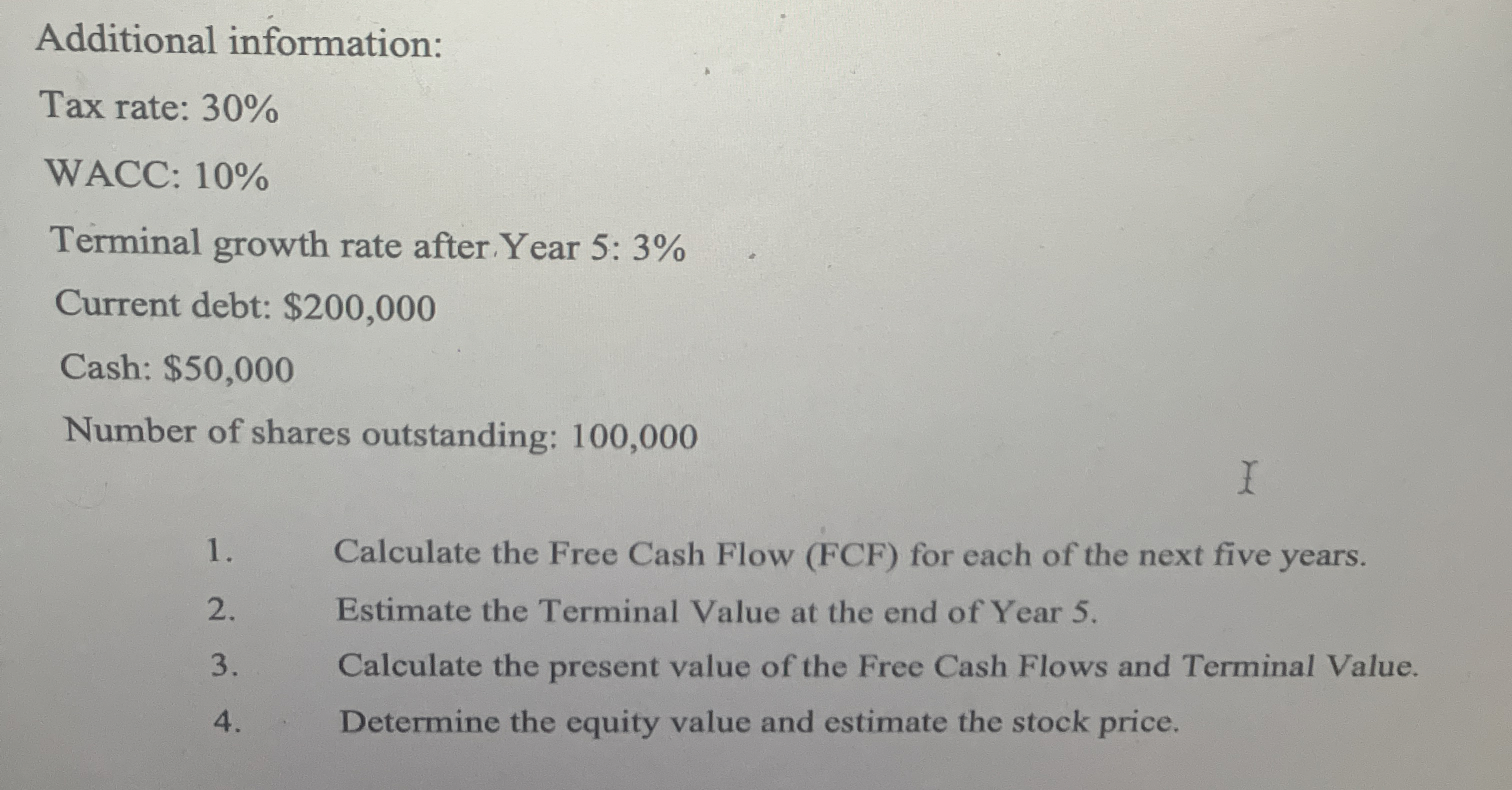

Additional information:

Tax rate:

WACC:

Terminal growth rate after.Year :

Current debt: $

Cash: $

Number of shares outstanding:

Calculate the Free Cash Flow FCF for each of the next five years.

Estimate the Terminal Value at the end of Year

Calculate the present value of the Free Cash Flows and Terminal Value.

Determine the equity value and estimate the stock price.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock