Question: Solve using excel ABC's the most recent free cash flow (FCF.) is $200 million. The free cash flow is expected to grow at a rate

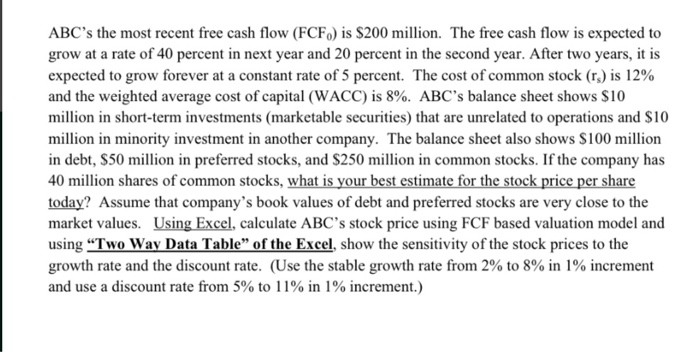

ABC's the most recent free cash flow (FCF.) is $200 million. The free cash flow is expected to grow at a rate of 40 percent in next year and 20 percent in the second year. After two years, it is expected to grow forever at a constant rate of 5 percent. The cost of common stock (rs) is 12% and the weighted average cost of capital (WACC) is 8%. ABC's balance sheet shows $10 million in short-term investments (marketable securities) that are unrelated to operations and $10 million in minority investment in another company. The balance sheet also shows $100 million in debt, $50 million in preferred stocks, and $250 million in common stocks. If the company has 40 million shares of common stocks, what is your best estimate for the stock price per share today? Assume that company's book values of debt and preferred stocks are very close to the market values. Using Excel, calculate ABC's stock price using FCF based valuation model and using "Two Way Data Table" of the Excel, show the sensitivity of the stock prices to the growth rate and the discount rate. (Use the stable growth rate from 2% to 8% in 1% increment and use a discount rate from 5% to 11% in 1% increment.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts