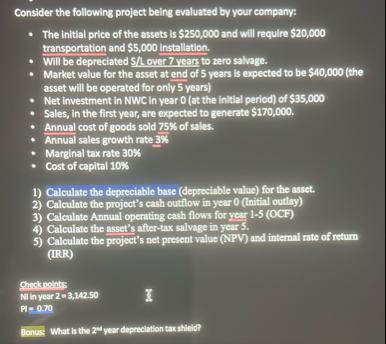

Question: Solve using excel. Consider the following project being evaluated by your company: The initial price of the assets is $ 2 5 0 , 0

Solve using excel. Consider the following project being evaluated by your company:

The initial price of the assets is $ and will require $ transportation and $ installation.

Will be depreciated $Lover years to zero salvage.

Market value for the asset at end of years is expected to be $the asset will be operated for only years

Net investment in NWC in year at the initial period of $

Sales, in the first year, are expected to generate $

Annual cost of goods sold of sales.

Annual sales growth rate

Marginal tax rate

Cost of capital

Calculate the depreciable base depreciable value for the asset.

Calculate the project's cash outflow in year Initial outlay

Calculate Annual operating cash flows for year OCF

Calculate the asset's aftertax salvege in year

Calculate the project's net present value WPV and internal rate of return IRR

Chrekprints

Miln year

Bonus: What is the year deprectation tax shield?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock