Question: Solve using excel During its current tax year (year one), a pharmaceutical company purchased a mixing tank that had a fair market price of $120,000.

Solve using excel

Solve using excel

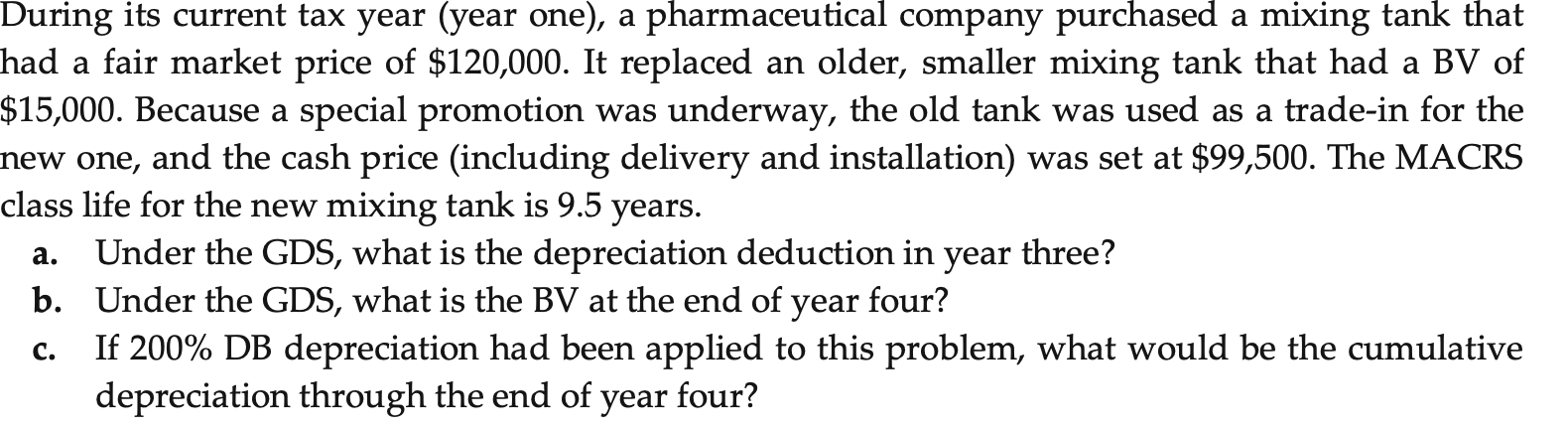

During its current tax year (year one), a pharmaceutical company purchased a mixing tank that had a fair market price of $120,000. It replaced an older, smaller mixing tank that had a BV of $15,000. Because a special promotion was underway, the old tank was used as a trade-in for the new one, and the cash price (including delivery and installation) was set at $99,500. The MACRS class life for the new mixing tank is 9.5 years. a. Under the GDS, what is the depreciation deduction in year three? b. Under the GDS, what is the BV at the end of year four? c. If 200% DB depreciation had been applied to this problem, what would be the cumulative depreciation through the end of year four? During its current tax year (year one), a pharmaceutical company purchased a mixing tank that had a fair market price of $120,000. It replaced an older, smaller mixing tank that had a BV of $15,000. Because a special promotion was underway, the old tank was used as a trade-in for the new one, and the cash price (including delivery and installation) was set at $99,500. The MACRS class life for the new mixing tank is 9.5 years. a. Under the GDS, what is the depreciation deduction in year three? b. Under the GDS, what is the BV at the end of year four? c. If 200% DB depreciation had been applied to this problem, what would be the cumulative depreciation through the end of year four

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts