Question: Solve using excel please show your work 7. (2.0 pt.) Suppose the following quotes are listed in the financial pages of your local newspaper: Current

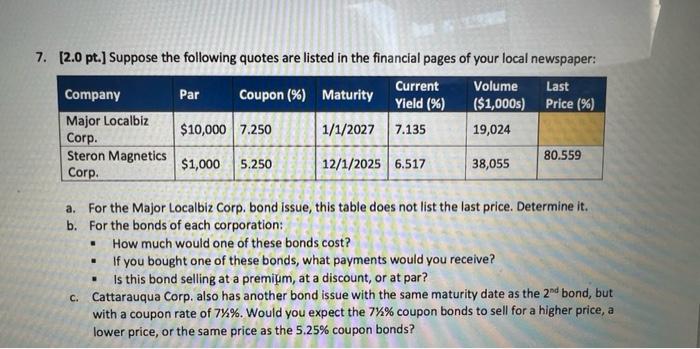

7. (2.0 pt.) Suppose the following quotes are listed in the financial pages of your local newspaper: Current Volume Last Company Par Coupon (%) Maturity Yield (%) ($1,000s) Price (%) Major Localbiz $10,000 7.250 1/1/2027 7.135 19,024 Corp. Steron Magnetics 80.559 $1,000 5.250 12/1/2025 6.517 38,055 Corp. . a. For the Major Localbiz Corp. bond issue, this table does not list the last price. Determine it. b. For the bonds of each corporation: How much would one of these bonds cost? If you bought one of these bonds, what payments would you receive? Is this bond selling at a premium, at a discount, or at par? c. Cattarauqua Corp. also has another bond issue with the same maturity date as the 2nd bond, but with a coupon rate of 7% %. Would you expect the 7%% coupon bonds to sell for a higher price, a lower price, or the same price as the 5.25% coupon bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts