Question: solve using excel Sam has a 32-year-old fridge that he thinks will last another 8 years. It consumes 1,400 kWh/year. He considers replacing the old

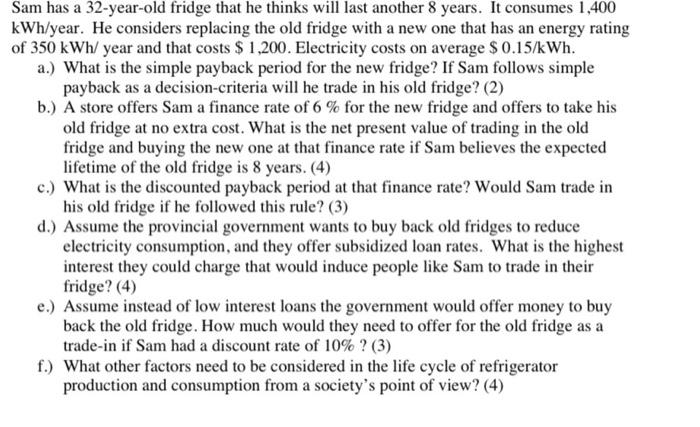

Sam has a 32-year-old fridge that he thinks will last another 8 years. It consumes 1,400 kWh/year. He considers replacing the old fridge with a new one that has an energy rating of 350 kWh/year and that costs $ 1,200. Electricity costs on average $ 0.15/kWh. a.) What is the simple payback period for the new fridge? If Sam follows simple payback as a decision-criteria will he trade in his old fridge? (2) b.) A store offers Sam a finance rate of 6 % for the new fridge and offers to take his old fridge at no extra cost. What is the net present value of trading in the old fridge and buying the new one at that finance rate if Sam believes the expected lifetime of the old fridge is 8 years. (4) c.) What is the discounted payback period at that finance rate? Would Sam trade in his old fridge if he followed this rule? (3) d.) Assume the provincial government wants to buy back old fridges to reduce electricity consumption, and they offer subsidized loan rates. What is the highest interest they could charge that would induce people like Sam to trade in their fridge? (4) e.) Assume instead of low interest loans the government would offer money to buy back the old fridge. How much would they need to offer for the old fridge as a trade-in if Sam had a discount rate of 10% ? (3) f.) What other factors need to be considered in the life cycle of refrigerator production and consumption from a society's point of view? (4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts