Question: solve using excel step by step Prob. 3 3 An Industrial machine is purchased for $175,000 and will result in annual revenue of $130,000. The

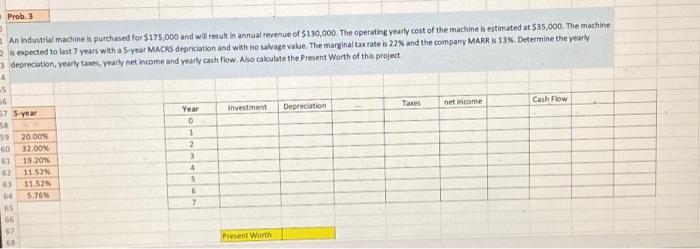

Prob. 3 3 An Industrial machine is purchased for $175,000 and will result in annual revenue of $130,000. The operating yearly cost of the machine is estimated at $35,000. The machine expected to last 7 years with a 5-year MACRS deprication and with no salvage value. The marginal tax rate is 22% and the company MARR is 13%. Determine the yearly 3 depreciation, yearly awes, yearly net income and yearly cash flow. Also calculate the present Worth of this project -5 Taxes net income Cash Flow Investment Depreciation 57 5.ver Year 0 1 2 3 4 5 20.00 32.00 19.20% 11 52 11.52 GO 63 7 55 GE GT 6 Present Worth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts