Question: Solve using Solver (Set solving method to Simplex LP) in Excel. MUTUAL FUN MODELING!! - The table below depicts the attributes of 10 mutual funds

Solve using Solver (Set solving method to Simplex LP) in Excel.

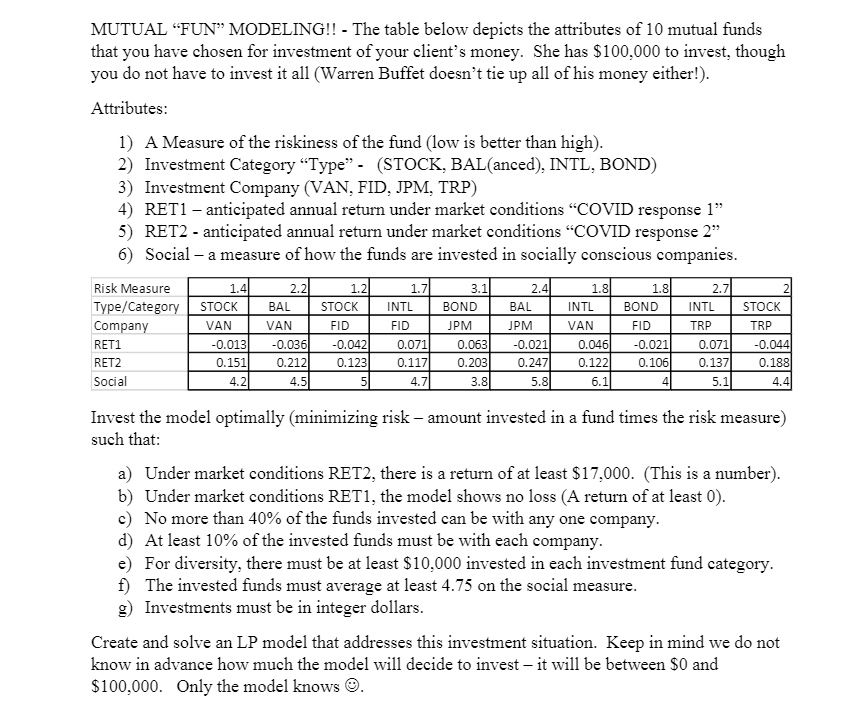

MUTUAL FUN MODELING!! - The table below depicts the attributes of 10 mutual funds that you have chosen for investment of your client's money. She has $100,000 to invest, though you do not have to invest it all (Warren Buffet doesn't tie up all of his money either!). Attributes: 1) A Measure of the riskiness of the fund (low is better than high). 2) Investment Category Type" - (STOCK, BAL(anced), INTL, BOND) 3) Investment Company (VAN, FID, JPM, TRP) 4) RET1 anticipated annual return under market conditions COVID response 1" 5) RET2 - anticipated annual return under market conditions COVID response 2" 6) Social a measure of how the funds are invested in socially conscious companies. 1.7 INTL 1.8 BOND FID FID Risk Measure Type/Category Company RET1 RET2 Social 1.4 STOCK VAN -0.013 0.151 4.2 2.2 BAL VAN -0.036 0.212 4.5 1.2 STOCK FID -0.042 0.123 51 3.1 BOND JPM 0.063 0.203 3.8 2.4 BAL JPM -0.021 0.247 5.81 1.81 INTL VAN 0.0461 0.122 6.1 2.7 INTL TRP 0.071 0.137 5.1 0.071 0.117 4.7 -0.021 0.106 4 STOCK TRP -0.0441 0.188 4.41 Invest the model optimally (minimizing risk - amount invested in a fund times the risk measure) such that: a) Under market conditions RET2, there is a return of at least $17,000. (This is a number). b) Under market conditions RET1, the model shows no loss (A return of at least 0). c) No more than 40% of the funds invested can be with any one company. d) At least 10% of the invested funds must be with each company. e) For diversity, there must be at least $10,000 invested in each investment fund category. f) The invested funds must average at least 4.75 on the social measure. g) Investments must be in integer dollars. Create and solve an LP model that addresses this investment situation. Keep in mind we do not know in advance how much the model will decide to invest - it will be between $0 and $100,000. Only the model knows O. MUTUAL FUN MODELING!! - The table below depicts the attributes of 10 mutual funds that you have chosen for investment of your client's money. She has $100,000 to invest, though you do not have to invest it all (Warren Buffet doesn't tie up all of his money either!). Attributes: 1) A Measure of the riskiness of the fund (low is better than high). 2) Investment Category Type" - (STOCK, BAL(anced), INTL, BOND) 3) Investment Company (VAN, FID, JPM, TRP) 4) RET1 anticipated annual return under market conditions COVID response 1" 5) RET2 - anticipated annual return under market conditions COVID response 2" 6) Social a measure of how the funds are invested in socially conscious companies. 1.7 INTL 1.8 BOND FID FID Risk Measure Type/Category Company RET1 RET2 Social 1.4 STOCK VAN -0.013 0.151 4.2 2.2 BAL VAN -0.036 0.212 4.5 1.2 STOCK FID -0.042 0.123 51 3.1 BOND JPM 0.063 0.203 3.8 2.4 BAL JPM -0.021 0.247 5.81 1.81 INTL VAN 0.0461 0.122 6.1 2.7 INTL TRP 0.071 0.137 5.1 0.071 0.117 4.7 -0.021 0.106 4 STOCK TRP -0.0441 0.188 4.41 Invest the model optimally (minimizing risk - amount invested in a fund times the risk measure) such that: a) Under market conditions RET2, there is a return of at least $17,000. (This is a number). b) Under market conditions RET1, the model shows no loss (A return of at least 0). c) No more than 40% of the funds invested can be with any one company. d) At least 10% of the invested funds must be with each company. e) For diversity, there must be at least $10,000 invested in each investment fund category. f) The invested funds must average at least 4.75 on the social measure. g) Investments must be in integer dollars. Create and solve an LP model that addresses this investment situation. Keep in mind we do not know in advance how much the model will decide to invest - it will be between $0 and $100,000. Only the model knows O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts