Question: solve using steps in next picture Q1: You work for a hedge fund and your job is to profit from possible arbitrages. You have the

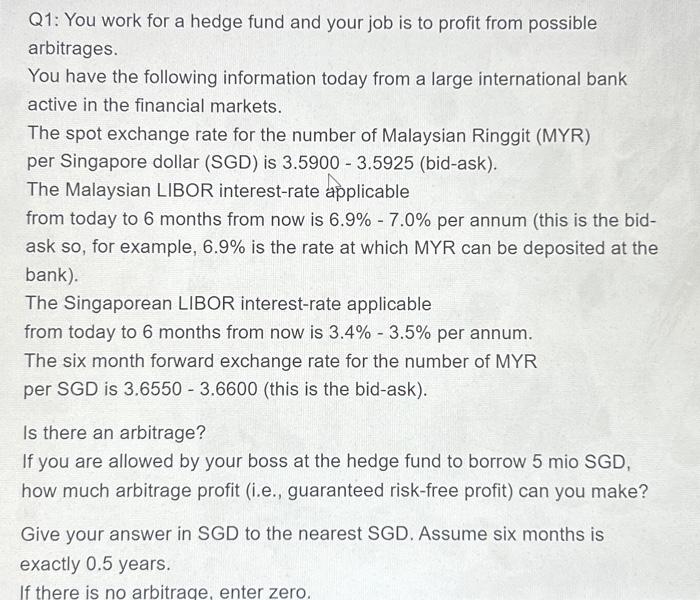

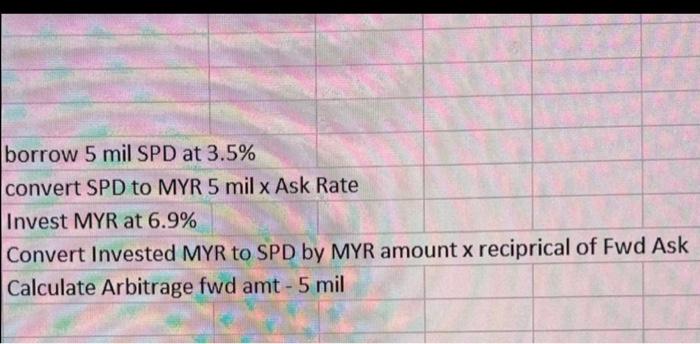

Q1: You work for a hedge fund and your job is to profit from possible arbitrages. You have the following information today from a large international bank active in the financial markets. The spot exchange rate for the number of Malaysian Ringgit (MYR) per Singapore dollar (SGD) is 3.59003.5925 (bid-ask). The Malaysian LIBOR interest-rate applicable from today to 6 months from now is 6.9%7.0% per annum (this is the bidask so, for example, 6.9% is the rate at which MYR can be deposited at the bank). The Singaporean LIBOR interest-rate applicable from today to 6 months from now is 3.4%3.5% per annum. The six month forward exchange rate for the number of MYR per SGD is 3.65503.6600 (this is the bid-ask). Is there an arbitrage? If you are allowed by your boss at the hedge fund to borrow 5 mio SGD, how much arbitrage profit (i.e., guaranteed risk-free profit) can you make? Give your answer in SGD to the nearest SGD. Assume six months is exactly 0.5 years. borrow 5 mil SPD at 3.5\% convert SPD to MYR 5 mil x Ask Rate Invest MYR at 6.9\% Convert Invested MYR to SPD by MYR amount x reciprical of Fwd Ask Calculate Arbitrage fwd amt - 5 mil

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts