Question: Solve using Visual Basic programming FICA Tax Write a program that calculates an employee's FICA tax, with all computations performed by an instance of a

Solve using Visual Basic programming

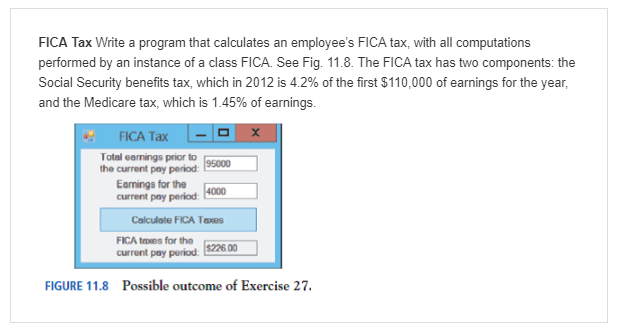

FICA Tax Write a program that calculates an employee's FICA tax, with all computations performed by an instance of a class FICA. See Fig. 11.8. The FICA tax has two components: the Social Security benefits tax, which in 2012 is 4.2% of the first $110,000 of earnings for the year. and the Medicare tax, which is 1.45% of earnings. FICA Tax 1-1 x Total eanings prior to the current pay period Earnings for the current pay period Calculate FICA Taxes FICA texes for the current pay period $2260 FIGURE 11.8 Possible outcome of Exercise 27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts