Question: solve ? value at maturity. A par value bond is one that sells at part the bond's coupon rate is equal to the going rate

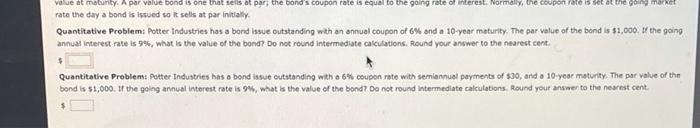

value at maturity. A par value bond is one that sells at part the bond's coupon rate is equal to the going rate of interest. Normally, the coupon rate is set at the going market rate the day a bond is issued so it sells at par initially Quantitative Problem: Potter Industries has a bond issue outstanding with an annual coupon of 6% and a 10-year maturity. The par value of the bond is $1,000. If the going annual interest rate is 9%, what is the value of the band? Do not round Intermediate calculations. Round your answer to the nearest cont. $ Quantitative Problem: Potter Industries has a bond issue outstanding with a 6% coupon rate with semiannual payments of $30, and a 10-year maturity. The par value of the bond is $1,000. If the poing annual interest rate is 9%, what is the value of the bond? Da not round intermediate calculations. Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts