Question: solve w work please 13. (a) The correlation coefficient for Visa's stock returns with the market's returns is 0.747788 . The standard deviation of Visa's

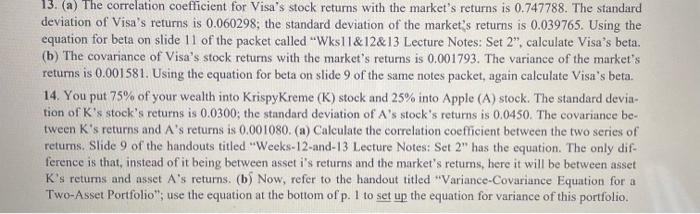

13. (a) The correlation coefficient for Visa's stock returns with the market's returns is 0.747788 . The standard deviation of Visa's returns is 0.060298 ; the standard deviation of the market's returns is 0.039765 . Using the equation for beta on slide 11 of the packet called "Wks 11&12&13 Lecture Notes: Set 2", calculate Visa's beta. (b) The covariance of Visa's stock returns with the market's returns is 0.001793 . The variance of the market's returns is 0.001581 . Using the equation for beta on slide 9 of the same notes packet, again calculate Visa's beta. 14. You put 75% of your wealth into KrispyKreme (K) stock and 25% into Apple (A) stock. The standard deviation of K's stock's returns is 0.0300 ; the standard deviation of A 's stock's returns is 0.0450 . The covariance between K 's returns and A 's returns is 0.001080 . (a) Calculate the correlation coefficient between the two series of returns. Slide 9 of the handouts titled "Weeks-12-and-13 Lecture Notes: Set 2" has the equation. The only difference is that, instead of it being between asset i's returns and the market's retums, here it will be between asset K 's returns and asset A 's returns. (b) Now, refer to the handout titled "Variance-Covariance Equation for a Two-Asset Portfolio"; use the equation at the bottom of p.1 to set up the equation for variance of this portfolio. 13. (a) The correlation coefficient for Visa's stock returns with the market's returns is 0.747788 . The standard deviation of Visa's returns is 0.060298 ; the standard deviation of the market's returns is 0.039765 . Using the equation for beta on slide 11 of the packet called "Wks 11&12&13 Lecture Notes: Set 2", calculate Visa's beta. (b) The covariance of Visa's stock returns with the market's returns is 0.001793 . The variance of the market's returns is 0.001581 . Using the equation for beta on slide 9 of the same notes packet, again calculate Visa's beta. 14. You put 75% of your wealth into KrispyKreme (K) stock and 25% into Apple (A) stock. The standard deviation of K's stock's returns is 0.0300 ; the standard deviation of A 's stock's returns is 0.0450 . The covariance between K 's returns and A 's returns is 0.001080 . (a) Calculate the correlation coefficient between the two series of returns. Slide 9 of the handouts titled "Weeks-12-and-13 Lecture Notes: Set 2" has the equation. The only difference is that, instead of it being between asset i's returns and the market's retums, here it will be between asset K 's returns and asset A 's returns. (b) Now, refer to the handout titled "Variance-Covariance Equation for a Two-Asset Portfolio"; use the equation at the bottom of p.1 to set up the equation for variance of this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts