Question: solve with deep explanation Company has started a contract on 10 March with Customer X. The contract was uncompleted as at 31 December. This is

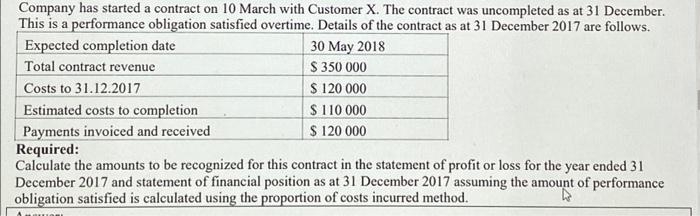

Company has started a contract on 10 March with Customer X. The contract was uncompleted as at 31 December. This is a performance obligation satisfied overtime. Details of the contract as at 31 December 2017 are follows. Expected completion date 30 May 2018 Total contract revenue $ 350 000 Costs to 31.12.2017 $ 120 000 Estimated costs to completion $ 110 000 Payments invoiced and received $ 120 000 Required: Calculate the amounts to be recognized for this contract in the statement of profit or loss for the year ended 31 December 2017 and statement of financial position as at 31 December 2017 assuming the amount of performance obligation satisfied is calculated using the proportion of costs incurred method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts