Question: solve with excel Example 7.4 P- $1 price per share for new shares m = 200,000 new shares issued Vo $4 n 1,000,000 shares The

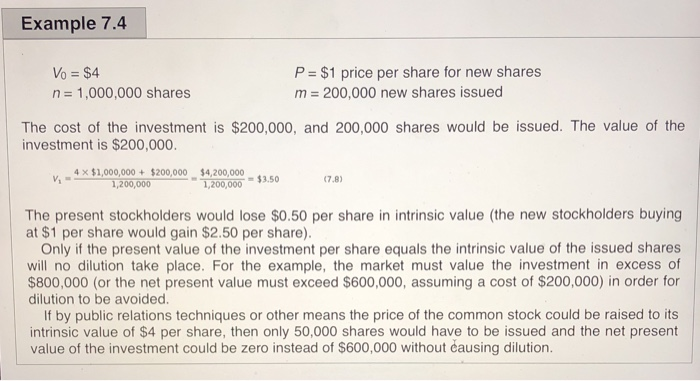

Example 7.4 P- $1 price per share for new shares m = 200,000 new shares issued Vo $4 n 1,000,000 shares The cost of the investment is $200,000, and 200,000 shares would be issued. The value of the investment is $200,000 4$1,000,000 + $200,000 1,200,000 $4,200,000 1,200,005" $3.50 7.8) The present stockholders would lose $0.50 per share in intrinsic value (the new stockholders buying at $1 per share would gain $2.50 per share) Only if the present value of the investment per share equals the intrinsic value of the issued shares will no dilution take place. For the example, the market must value the investment in excess of $800,000 (or the net present value must exceed $600,000, assuming a cost of $200,000) in order for dilution to be avoided If by public relations techniques or other means the price of the common stock could be raised to its intrinsic value of $4 per share, then only 50,000 shares would have to be issued and the net present value of the investment could be zero instead of $600,000 without causing dilution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts