Question: Solve with specific steps. Thanks. Please! be clear and specific The price of a certain security follows a geometric Brownian motion with drift parameter j

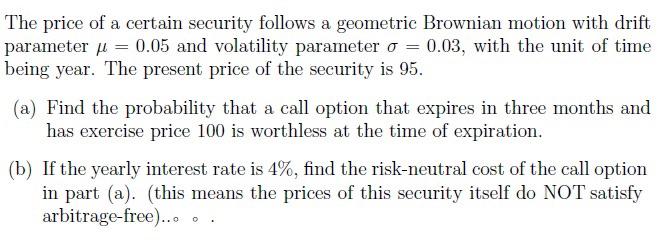

The price of a certain security follows a geometric Brownian motion with drift parameter j = 0.05 and volatility parameter o = 0.03, with the unit of time being year. The present price of the security is 95. (a) Find the probability that a call option that expires in three months and has exercise price 100 is worthless at the time of expiration. (b) If the yearly interest rate is 4%, find the risk-neutral cost of the call option in part (a). (this means the prices of this security itself do NOT satisfy arbitrage-free)... o. The price of a certain security follows a geometric Brownian motion with drift parameter j = 0.05 and volatility parameter o = 0.03, with the unit of time being year. The present price of the security is 95. (a) Find the probability that a call option that expires in three months and has exercise price 100 is worthless at the time of expiration. (b) If the yearly interest rate is 4%, find the risk-neutral cost of the call option in part (a). (this means the prices of this security itself do NOT satisfy arbitrage-free)... o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts