Question: solve with this formula From Table 5-5, the asked (or discount) yield on the T-bill maturing on November 3, 2016 (or 171 days from the

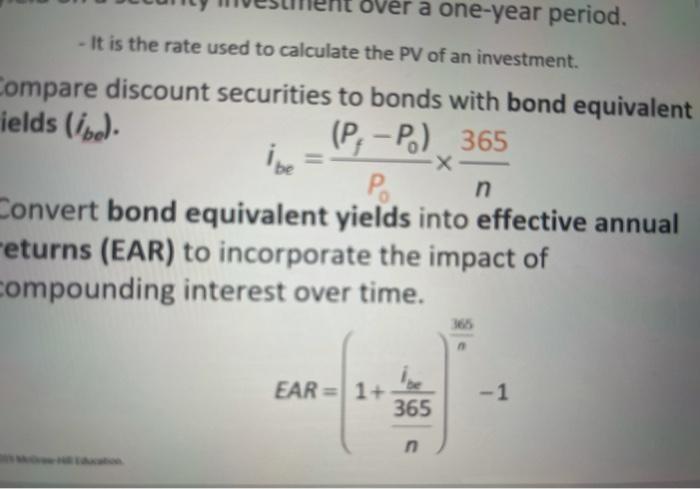

From Table 5-5, the asked (or discount) yield on the T-bill maturing on November 3, 2016 (or 171 days from the settlement date, May 17, 2016). is 0.328 percent. The T-bill price for these T-bills is calculated as: er a one-year period. It is the rate used to calculate the PV of an investment. be -X Compare discount securities to bonds with bond equivalent ields (ibe). (P;-P) 365 P . Convert bond equivalent yields into effective annual returns (EAR) to incorporate the impact of compounding interest over time. n EAR = 1+ 365 - 1 n From Table 5-5, the asked (or discount) yield on the T-bill maturing on November 3, 2016 (or 171 days from the settlement date, May 17, 2016). is 0.328 percent. The T-bill price for these T-bills is calculated as: er a one-year period. It is the rate used to calculate the PV of an investment. be -X Compare discount securities to bonds with bond equivalent ields (ibe). (P;-P) 365 P . Convert bond equivalent yields into effective annual returns (EAR) to incorporate the impact of compounding interest over time. n EAR = 1+ 365 - 1 n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts