Question: solve WITHOUT A FINANCIAL CALCULATOR OR EXCEL 6. Predicting Bond Values. (Use the chapter appendix to answer this problem.) Sun Devil Savings has just purchased

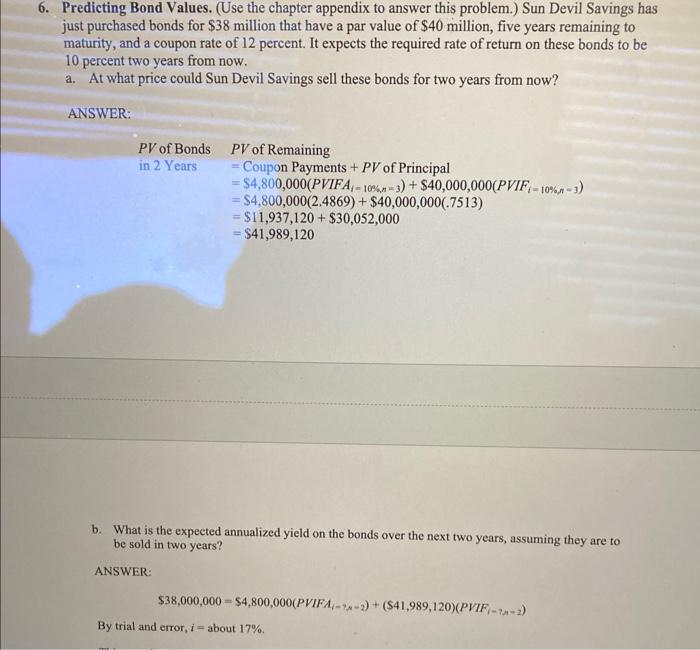

6. Predicting Bond Values. (Use the chapter appendix to answer this problem.) Sun Devil Savings has just purchased bonds for $38 million that have a par value of $40 million, five years remaining to maturity, and a coupon rate of 12 percent. It expects the required rate of return on these bonds to be 10 percent two years from now. a. At what price could Sun Devil Savings sell these bonds for two years from now? ANSWER: PV of Bonds in 2 Years PV of Remaining Coupon Payments + PV of Principal = $4,800,000(PVIFA, -10% - 3) + $40,000,000(PVIF-10% - ) = $4,800,000(2.4869) + $40,000,000(.7513) = $11,937,120 + $30,052,000 $41,989,120 % - b. What is the expected annualized yield on the bonds over the next two years, assuming they are to be sold in two years? ANSWER: $38,000,000 - $4,800,000(PVIFA-A-2) + (841,989,120)(PVIF - 1,-2) By trial and error, i = about 17%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts