Question: solve without using excel... show steps 22. You are considering making a movie. The movie is expected to cost $10 million up front and take

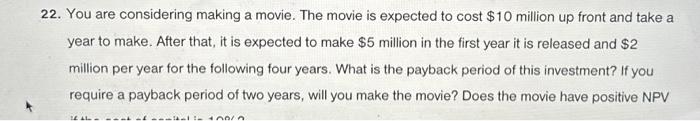

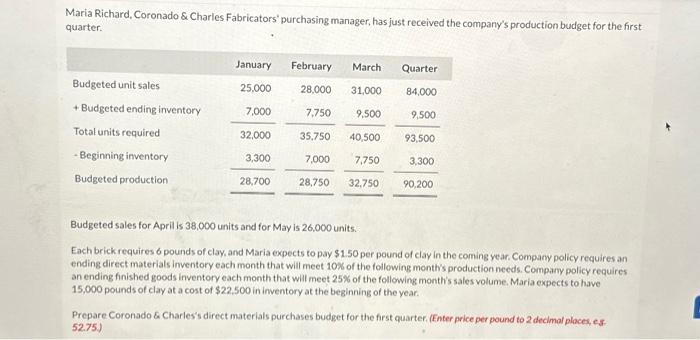

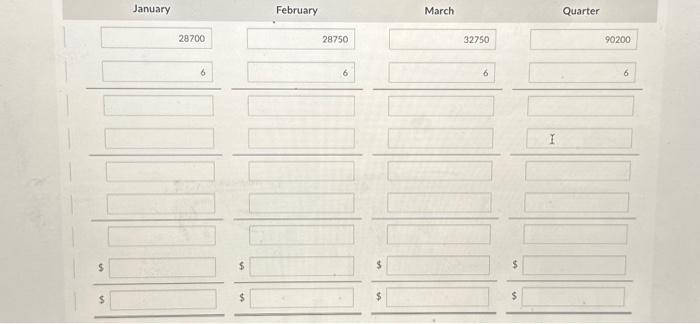

22. You are considering making a movie. The movie is expected to cost $10 million up front and take a year to make. After that, it is expected to make $5 million in the first year it is released and $2 million per year for the following four years. What is the payback period of this investment? If you require a payback period of two years, will you make the movie? Does the movie have positive NPV Maria Richard, Coronado \& Charles Fabricators' purchasing manager, has just received the company's production budget for the first quarter. Budgeted sales for April is 38,000 units and for May is 26,000 units. Each brick requires 6 pounds of elsy, and Maria expects to pay $1.50 per pound of clay in the coming year. Company policy requires an ending direct materials inventory each month that will meet 10% of the following months production needs. Company policy requires an ending finished goods inventory each month that will meet 25% of the following month's sales volume. Maria expects to have 15,000 pounds of clay at a cost of $22,500 in inventory at the beginning of the year. Prepare Coronado 6 Charles's direct materials purchases budget for the first quarter. (Enter price per pound to 2 decimal places, es 52.75)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts