Question: ( Solving a comprehensive problem ) Use the end - of - year stock price data in the popup window, , to answer the following

Solving a comprehensive problem Use the endofyear stock price data in the popup window, to answer the following questions for the Harris and Pinwheel companies.

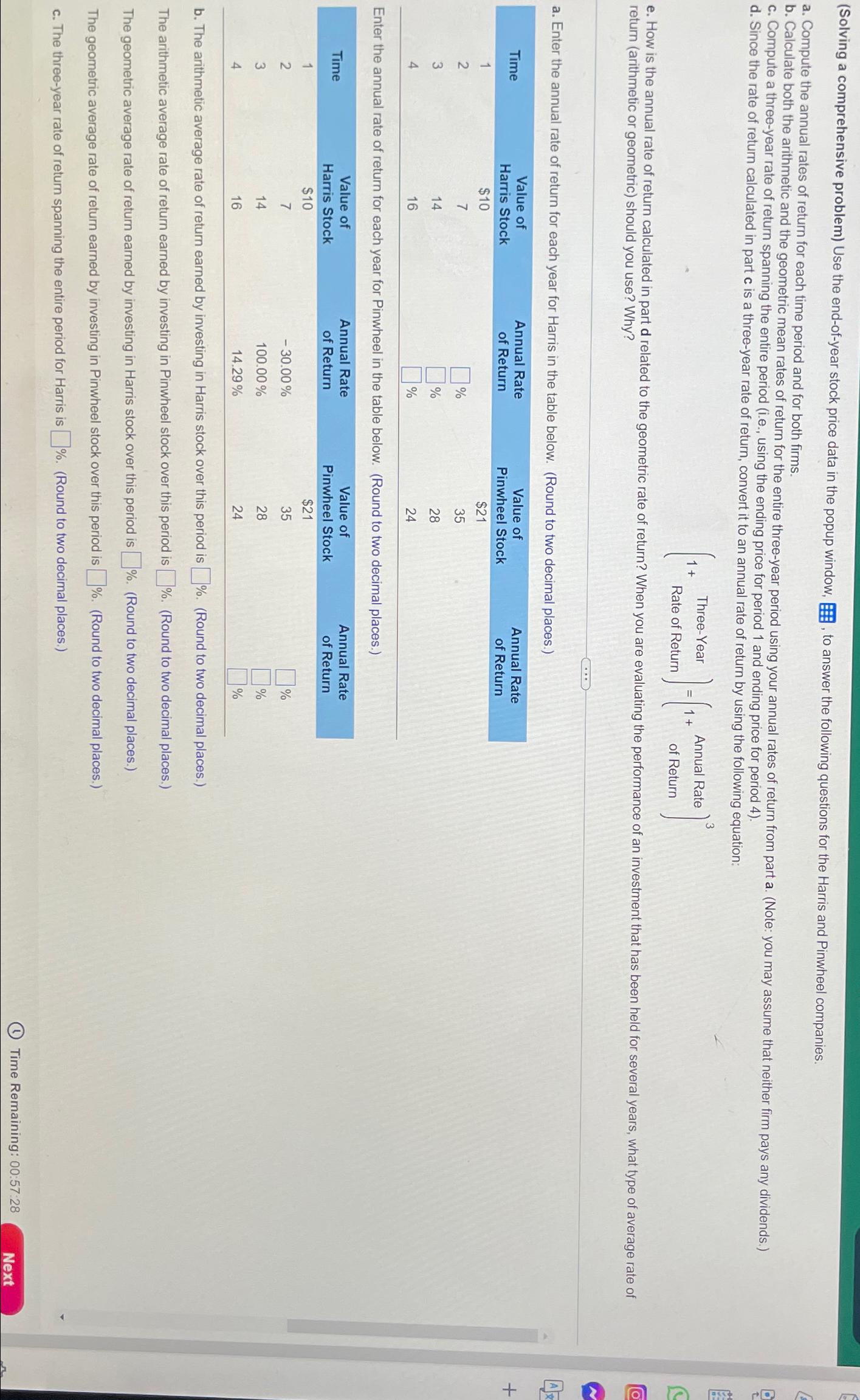

a Compute the annual rates of return for each time period and for both firms.

c Compute a threeyear rate of return spanning the entire period ie using the ending price for period and ending price for period

d Since the rate of return calculated in part is a threeyear rate of return, convert it to an annual rate of return by using the following equation:

ThreeYear Rate Return Annual Rate Return

return arithmetic or geometric should you use? Why?

a Enter the annual rate of return for each year for Harris in the table below. Round to two decimal places.

tableTimetableValue ofHarris StocktableAnnual Rateof ReturntableValue ofPinwheel StocktableAnnual Rateof Return$$

Enter the annual rate of return for each year for Pinwheel in the table below. Round to two decimal places.

tableTimetableValue ofHarris StocktableAnnual Rateof ReturntableValue ofPinwheel StocktableAnnual Rateof Return$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock