Question: (Solving for i) A financial planner just offered you a new investment product that would require an initial investment on your part of $45,000, and

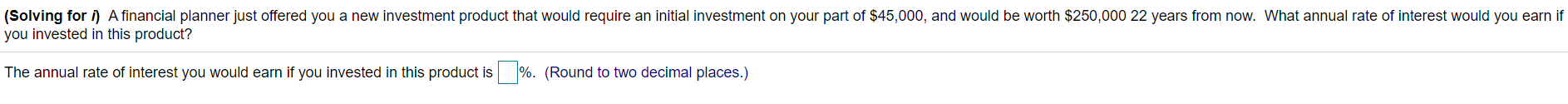

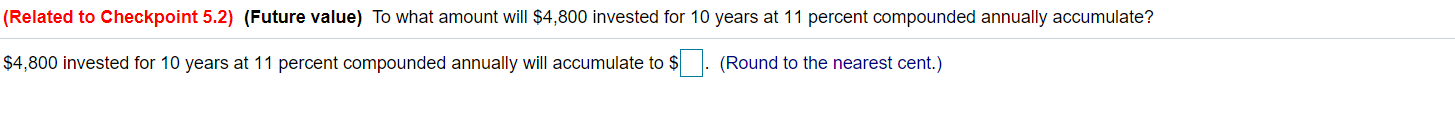

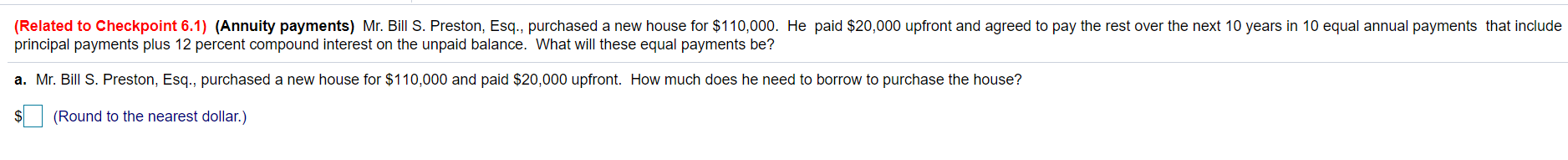

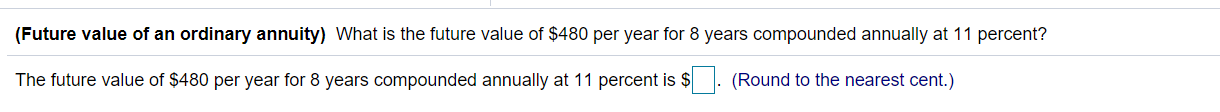

(Solving for i) A financial planner just offered you a new investment product that would require an initial investment on your part of $45,000, and would be worth $250,000 22 years from now. What annual rate of interest would you earn if you invested in this product? The annual rate of interest you would earn if you invested in this product is %. (Round to two decimal places.) (Related to Checkpoint 5.2) (Future value) To what amount will $4,800 invested for 10 years at 11 percent compounded annually accumulate? $4,800 invested for 10 years at 11 percent compounded annually will accumulate to $ . (Round to the nearest cent.) (Related to Checkpoint 6.1) (Annuity payments) Mr. Bill S. Preston, Esq., purchased a new house for $110,000. He paid $20,000 upfront and agreed to pay the rest over the next 10 years in 10 equal annual payments that include principal payments plus 12 percent compound interest on the unpaid balance. What will these equal payments be? a. Mr. Bill S. Preston, Esq., purchased a new house for $110,000 and paid $20,000 upfront. How much does he need to borrow to purchase the house? $ (Round to the nearest dollar.) (Future value of an ordinary annuity) What is the future value of $480 per year for 8 years compounded annually at 11 percent? The future value of $480 per year for 8 years compounded annually at 11 percent is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts