Question: solving with ba2 financial calculator 11. What would be the selling price of a bond that has a coupon rate of 5.5%, it has 15

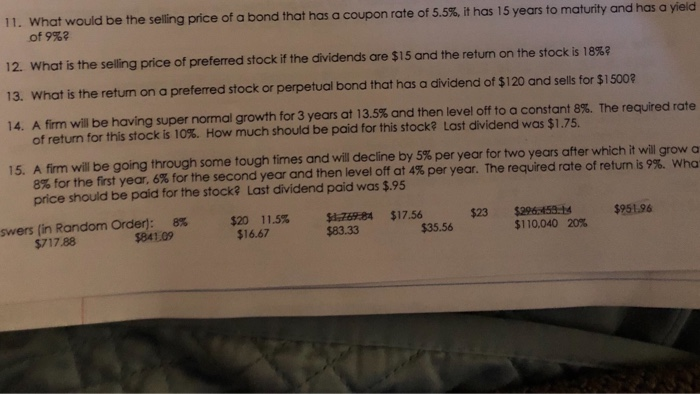

11. What would be the selling price of a bond that has a coupon rate of 5.5%, it has 15 years to maturity and has a yield of 9%? 12. What is the selling price of preferred stock if the dividends are $15 and the return on the stock is 18% 13. What is the return on a preferred stock or perpetual bond that has a dividend of $120 and sells for $1500 14. A firm will be having super normal growth for 3 years at 13.5% and then level off to a constant 8%. The required rate of return for this stock is 10% How much should be paid for this stock? Last dividend was $1.75. 15. A firm will be going through some tough times and will decline by 5% per year for two years after which it will grow a 8% for the first year, 6% for the second year and then level off at 4% per year. The required rate of return is 9%. Whar price should be paid for the stockLast dividend paid was $.95 8% $20 11.5% swers (in Random Order): $1,764.84 $23 $17.56 $296.59.14 $951.96 $841.09 $717.88 $16.67 $83.33 $110,040 20% $35.56

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts