Question: Some assistants please. We Do It Right has been in operation for a few years and its financial year ends on December 31 . It

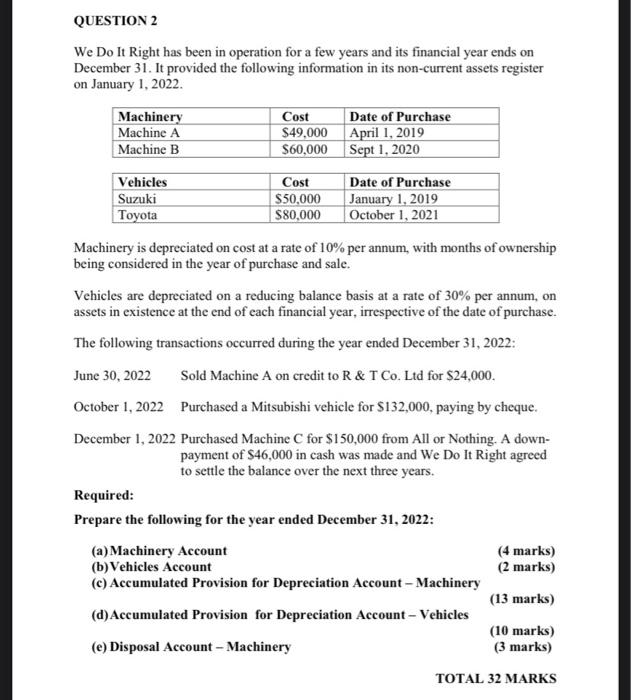

We Do It Right has been in operation for a few years and its financial year ends on December 31 . It provided the following information in its non-current assets register on January 1, 2022. Machinery is depreciated on cost at a rate of 10% per annum, with months of ownership being considered in the year of purchase and sale. Vehicles are depreciated on a reducing balance basis at a rate of 30% per annum, on assets in existence at the end of each financial year, irrespective of the date of purchase. The following transactions occurred during the year ended December 31, 2022: June 30, 2022 Sold Machine A on credit to R \& T Co. Ltd for $24,000. October 1, 2022 Purchased a Mitsubishi vehicle for $132,000, paying by cheque. December 1, 2022 Purchased Machine C for $150,000 from All or Nothing. A downpayment of $46,000 in cash was made and We Do It Right agreed to settle the balance over the next three years. Required: Prepare the following for the year ended December 31, 2022: (a) Machinery Account (4 marks) (b) Vehicles Account (2 marks) (c) Accumulated Provision for Depreciation Account - Machinery (13 marks) (d)Accumulated Provision for Depreciation Account - Vehicles (10 marks) (e) Disposal Account - Machinery (3 marks) TOTAL 32 MARKS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts