Question: Some background information: Require return= 10.1% WACC = 10.1% QUESTION: What is the IRR and NPV? (please provide your workings) Table 1 - Product Market

Some background information:

Require return= 10.1%

WACC = 10.1%

QUESTION:

What is the IRR and NPV? (please provide your workings)

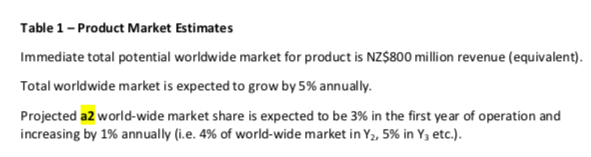

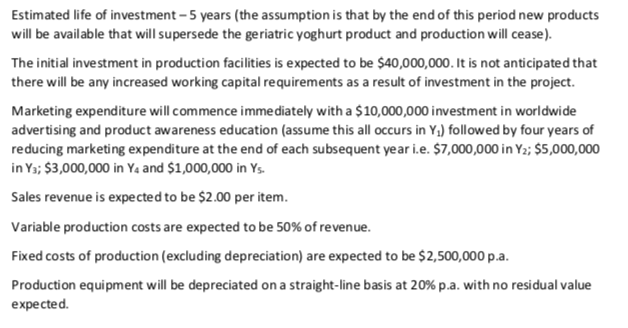

Table 1 - Product Market Estimates Immediate total potential worldwide market for product is NZ$800 million revenue (equivalent). Total worldwide market is expected to grow by 5% annually. Projected a2 world-wide market share is expected to be 3% in the first year of operation and increasing by 1% annually (i.e. 4% of world-wide market in Y2, 5% in Y, etc.). Estimated life of investment - 5 years (the assumption is that by the end of this period new products will be available that will supersede the geriatric yoghurt product and production will cease). The initial investment in production facilities is expected to be $40,000,000. It is not anticipated that there will be any increased working capital requirements as a result of investment in the project. Marketing expenditure will commence immediately with a $10,000,000 investment in worldwide advertising and product awareness education (assume this all occurs in Y,) followed by four years of reducing marketing expenditure at the end of each subsequent year i.e. $7,000,000 in Yz; $5,000,000 in Ya; $3,000,000 in Ya and $1,000,000 in Ys. Sales revenue is expected to be $2.00 per item. Variable production costs are expected to be 50% of revenue. Fixed costs of production (excluding depreciation) are expected to be $2,500,000 p.a. Production equipment will be depreciated on a straight-line basis at 20% p.a. with no residual value expected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts