Question: Some Company uses the allowance method for handling receivables. Total Sales for the year were $975,000 ($725,000 credit sales and $250,000 cash sales). The unadjusted

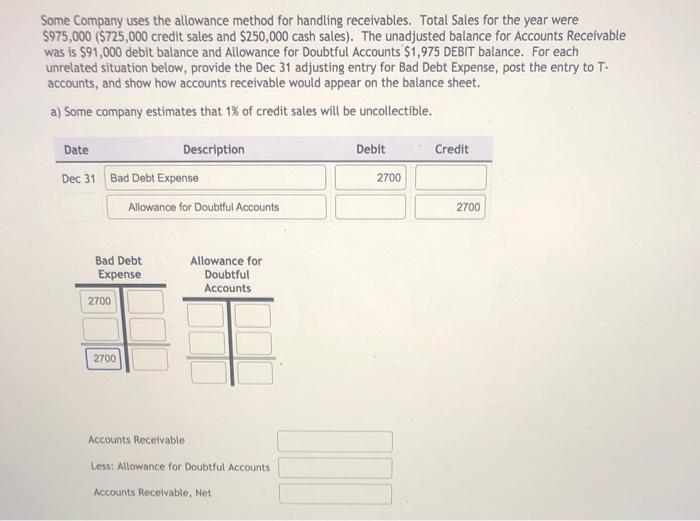

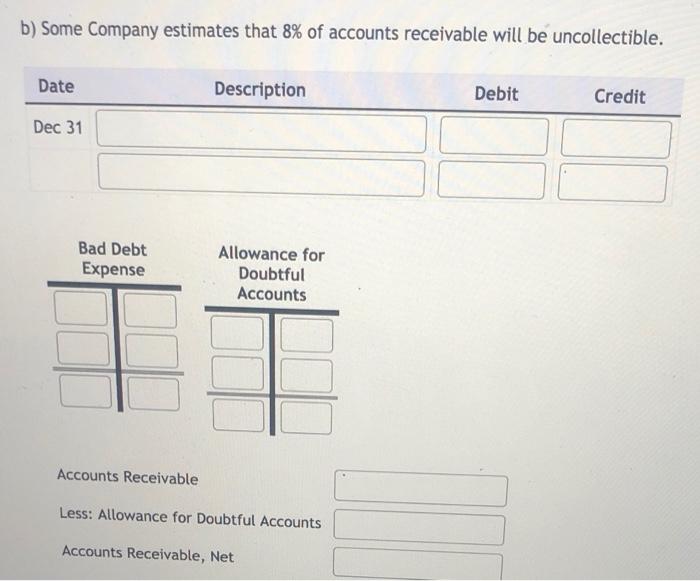

Some Company uses the allowance method for handling receivables. Total Sales for the year were $975,000 ($725,000 credit sales and $250,000 cash sales). The unadjusted balance for Accounts Receivable was is $91,000 debit balance and Allowance for Doubtful Accounts $1,975 DEBIT balance. For each unrelated situation below, provide the Dec 31 adjusting entry for Bad Debt Expense, post the entry to T. accounts, and show how accounts receivable would appear on the balance sheet. a) Some company estimates that 1% of credit sales will be uncollectible. Credit Date Description Dec 31 Bad Debt Expense Debit 2700 Allowance for Doubtful Accounts 2700 Bad Debt Expense 2700 Allowance for Doubtful Accounts 2700 Accounts Receivable Less: Allowance for Doubtful Accounts Accounts Receivable, Net b) Some Company estimates that 8% of accounts receivable will be uncollectible. Date Description Debit Credit Dec 31 Bad Debt Expense Allowance for Doubtful Accounts Accounts Receivable Less: Allowance for Doubtful Accounts Accounts Receivable, Net

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts