Question: Some Discounting Problems 1. US with a Suppose you just graduated from UCR and have 2 offers. The first is a job offer at Jobs

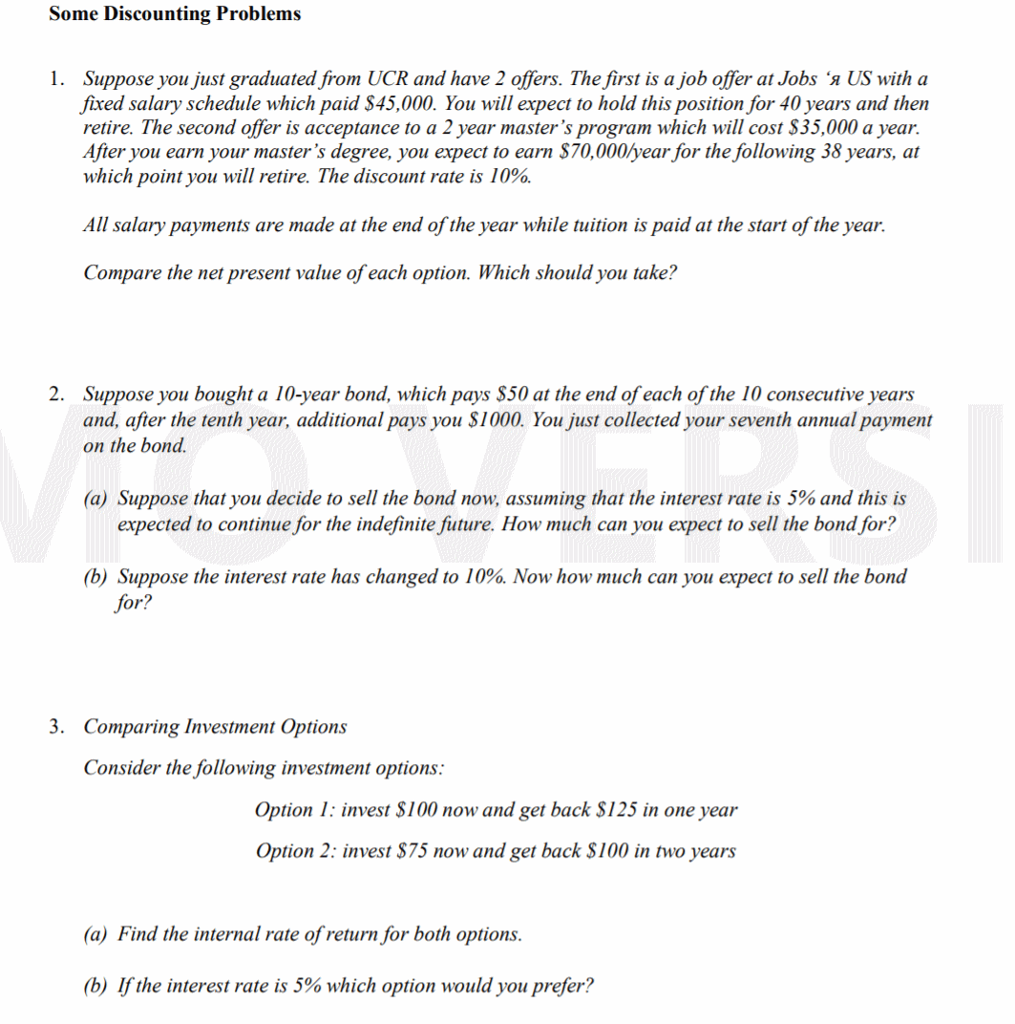

Some Discounting Problems 1. US with a Suppose you just graduated from UCR and have 2 offers. The first is a job offer at Jobs a fixed salary schedule which paid S45,000. You will expect to hold this position for 40 years and then retire. The second offer is acceptance to a 2 year master's program which will cost S35,000 a year. After you earn your master's degree, you expect to earn $70,000year for the following 38 years, at which point you will retire. The discount rate is 10%. All salary payments are made at the end of the year while tuition is paid at the start of the year. Compare the net present value of each option. Which should you take? 2. Suppose you bought a l0-year bond, which pays S50 at the end of each of the 10 consecutive years and, after the tenth year, additional pays you S1000. You just collected your seventh annual payment on the bond (a) Suppose that you decide to sell the bond now, assuming that the interest rate is 5% and this is expected to continue for the indefinite fiuture. How much can you expect to sell the bond for? (b) Suppose the interest rate has changed to 10%. Now how much can you expect to sell the bond for? 3. Comparing Investment Options Consider the following investment options Option 1 invest S100 now and get back S125 in one year Option 2: invest S75 now and get back S100 in two years (a) Find the internal rate of return for both options (b) If the interest rate is 5% which option would you prefer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts